Let’s start by answering some common questions about home insurance. Whether you’re in the market for your first home or are a longtime homeowner, you should make sure you know how homeowners’ insurance works.

Is the Homeowners’ Insurance Required?

Unlike auto insurance, homeowners’ insurance is not legally required by the state of Missouri. However, if you finance your home, as most homeowners do, your mortgage lender will most likely require you to have insurance on your home. This protects both them and you from potential perils that could affect you and your home.

Even if you buy a home outright and don’t have to answer to a bank or lending company, it’s still wise to purchase home insurance policy right away so you don’t risk losing your investment over a robbery, tornado or other peril.

How Do Deductibles Work With Home Insurance?

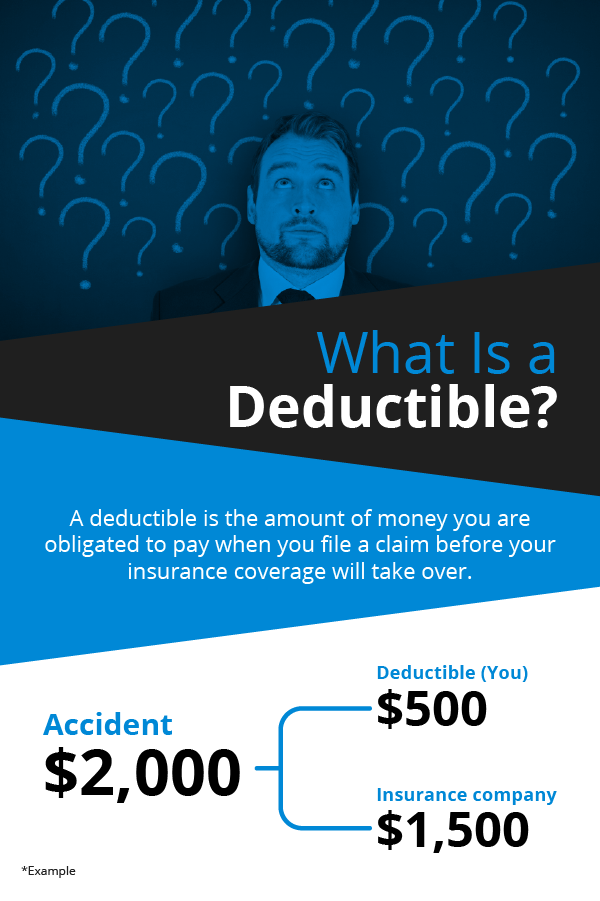

A deductible is money you must pay out of pocket, defined by either a percentage or a dollar amount, before your insurance kicks in. Different categories of coverage on your policy may have their own deductibles. For example, you may have a $500 deductible for certain damages and a $1,000 deductible for others. If your deductible is $1,000, and you file a claim for $8,000, that means you’ll pay $1,000, and your insurance company will cover the remaining $7,000.

A lower deductible may sound better, but it will mean higher premiums. If you want to pay lower premiums, you should opt for a higher deductible. There is no one-size-fits-all answer for the best deductible and premium combination, but many people feel it’s better to go with a higher deductible, as long as it’s one they could afford if they needed to file a claim, so they can have a lower premium.

Does Home Insurance Cover My Personal Valuables?

The short answer is yes, if your personal valuables, such as jewelry, are stolen or damaged by a peril listed in your policy, your home insurance will cover the cost to replace those valuables. However, a standard homeowners’ policy will only cover valuables up to a specified maximum amount. If you have jewelry or other valuables that would cost more to replace than your standard policy will pay, you may want to consider adding a floater or endorsement onto your homeowners’ policy.

A floater can help make up the difference and will even cover losses to your jewelry that aren’t covered by your home insurance. For example, it would cover the cost to replace your wedding ring if you accidentally lost it. If you want to get a floater, you’ll have to get your valuables appraised so the insurance company can accurately determine the cost to replace them.

How Will Home Insurance Help Me If My Home Becomes Uninhabitable?

Some perils may cause your home to become unsafe to live in. This could include damage from a severe storm or fire, for example. When this happens, you have to worry about fixing the issue or, in the worst cases, rebuilding your home, and you also have to worry about where you’re going to live while your home is uninhabitable.

The good news is that, if your home is uninhabitable due to a peril covered by your homeowners’ insurance, then your insurance will also pay for you to stay at a hotel for up to a specific number of days or up to a maximum dollar amount, whichever comes first.

Does Homeowners’ Insurance Cover Damage From Natural Disasters?

In addition to covering perils like theft, homeowners’ insurance also covers damages from some natural disasters. Most standard policies cover damage from storms, including wind, lightning and hail, as well as damage from fires, which includes both structure fires and wildfires. This means that if any of these disasters occur, your home insurance will pay to replace your lost or damaged property and even rebuild your home from the ground up if necessary.

If you live in an area where earthquakes or floods are an issue, you may want to purchase separate insurance policies for these natural disasters. If hurricanes are a concern, you can likely count on your home insurance to cover wind damage but not damage from flooding. Every policy is different, so you should make sure you understand the details of your policy. If you’re concerned about potential gaps, then ask how you can add more coverage for these events.

What’s the Difference in Replacement Cost and Actual Cash Value?

Two terms you may hear in relation to homeowners’ insurance is “replacement cost” and “actual cash value.” These terms are similar, so there’s confusion as to the difference. Both of these terms have to do with your insurance company paying to replace lost or damaged property.

The difference is that replacement cost means you get paid what it would cost to replace the lost property, while actual cash value (ACV) takes depreciation into account and pays you what your property was worth at the time it was lost or damaged. In other words, if your television were stolen, and you were awarded the replacement cost, you could go out and buy a new TV. If you were awarded the ACV, that means you’d get the amount you might get for your TV if you sold it in a garage sale.

What Is Liability Coverage?

Homeowners’ insurance doesn’t just cover your property. It also protects you from possible legal costs. For example, if a visitor to your home tripped on a loose board on the stairs, stepped on a nail on your deck, or was bitten by your dog, they could choose to file a lawsuit against you.

Lawsuits are expensive, so this could quickly turn into a major financial burden if you were uninsured. The good news is that your home insurance will cover these legal costs as part of your liability coverage.

What Affects Home Insurance Premiums?

Premiums are the regular payments you make to maintain your insurance coverage. A variety of factors play into setting the amount you pay. The most influential factors come down to your coverage level and the risk level you and your home present.

-

- Coverage level: As for coverage level, you have some control over selecting your coverage level, but it should reflect the value of your home and property. If you have a more expensive home, it will cost more to rebuild, so you’ll need to insure it for more. A smaller, more affordable house, on the other hand, will mean you need less coverage, resulting in lower premiums.

- Risk level: Insurance companies also assess the possible risk you and your home bring to the table when setting your premiums. Your own risk has to do with how likely you are to file a claim, which the insurance company determines based on your financial history and demographic information. Your property’s risk level has to do with how many possible hazards it presents.

Should I Cancel My Homeowners’ Insurance When I Place My House on the Market?

When you stop inhabiting your home and place it on the market for sale, you may wonder if this means it’s time to cancel your insurance policy. Canceling your policy at this point would be a mistake because there are still problems that could occur in your home, leading to great financial loss if you are uninsured. Until a buyer has officially closed on your home, any theft, damage from storms or fires or any other peril would still be your responsibility to handle.

Another potential issue is that, as real estate agents and buyers tour your home, they could become injured and sue you for damages. No matter what unfortunate situation affects you and your home, you’ll be glad you held onto that insurance policy.

How Do I Know When I Should File a Claim?

Filing a claim is how you officially request funds from your insurance company. At David Pope, we’ll speak with you before you officially file a claim to make sure it’s wise to do so. This is for your protection because filing an insurance claim will cause your rates to go up, regardless of whether the insurance company actually pays you. This increase in your premiums is worth it if you need help, and your insurance company recognizes that the help you need is covered in your policy.

However, you should be careful to make sure your policy really does cover a problem and check your deductible to see if you’ll get enough from the insurance company to justify filing a claim. For example, if your deductible is $500 and you’re asking for $600, you’ll end up paying higher premiums just for $100, which won’t be worth it in the long run. When in doubt, get a bid for what the cost would be to get the damage repaired first. (some agents or companies are legally required to start a claims process as soon as you as)