Missouri is known for its mouthwatering barbeques, numerous natural wonders and for being the birthplace of Mark Twain. Unfortunately, it’s also synonymous with destructive weather conditions — the state holds the U.S. records for the most powerful earthquake in 1811 and the most disastrous tornado in 1925, which impacted almost 90% of Missouri.

While Missouri is not considered part of “tornado alley,” homeowners in this state still encounter approximately 30 tornados each year. This makes it paramount that you select home insurance that provides adequate coverage for natural disasters, theft and other damages.

David Pope Insurance Services, LLC, is a Missouri-based company dedicated to helping residents find the right home insurance policy for their needs. Here’s everything you need to consider when searching for home insurance quotes in Missouri.

To know how to determine the amount of coverage you need and ways to save on insurance premiums, you should understand some home insurance basics first.

Homeowners insurance is not legally required in Missouri. However, lenders often require it as long as you have a mortgage.

According to the Missouri Department of Insurance, all basic home insurance policies will cover you for property damages caused by:

This means that you will need to purchase additional coverage to protect you against things like floods, earthquakes, drain damage and general wear and tear.

Understanding home insurance policies — at least on a basic level — helps you choose the best one for your needs. But between the jargon and the many different coverage types, limits and deductibles, it can be challenging for homeowners to make an informed decision. That’s where an insurance agent or broker comes in.

By partnering with a home insurance agent in Missouri, you benefit from their in-depth knowledge about insurance and risks. Professional brokers will take the time to discuss your needs and provide accurate advice regarding the amount of coverage you require. You can also ask brokers specific questions so you feel more empowered to make the right choice.

If your property is damaged, you certainly don’t want to be underinsured. However, paying expensive premiums for excessive coverage is not an effective use of your hard-earned cash. Here are some key factors to help you select the right insurance coverage.

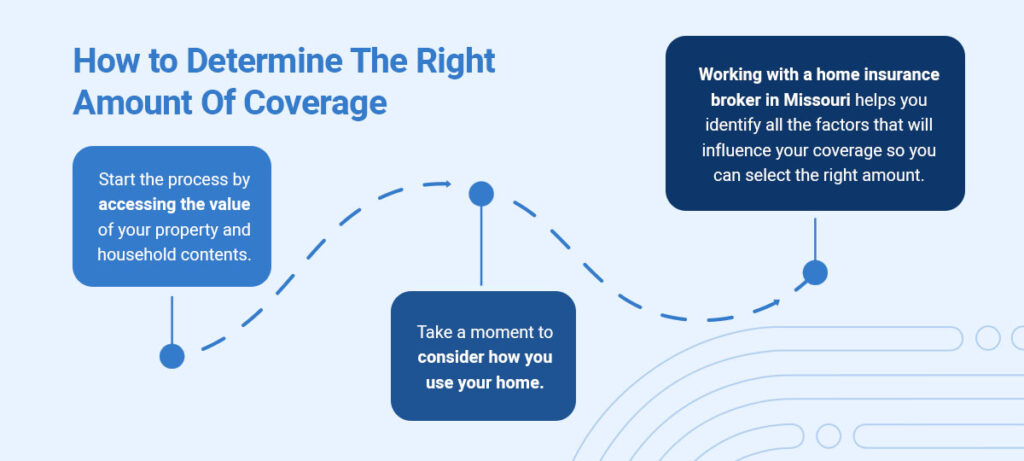

Start the process by accessing the value of your property and household contents. The Missouri Department of Insurance provides a helpful home inventory checklist for homeowners to track their belongings.

In addition, take a moment to consider how you use your home. If your house doubles as a business premises, you may want to add another policy to cover business equipment. Storing expensive jewelry or firearms on your property will also impact your coverage.

Working with a home insurance broker in Missouri helps you identify all the factors that will influence your coverage so you can select the right amount.

With so many home insurance options to choose from, how do you know you’re selecting the right one? Start by requesting quotes from licensed insurance providers in your area. While premiums matter, the type of coverage and customer service each company offers is as critical.

Reviewing common questions about homeowners insurance can help you create your own list of queries to clarify with a broker. In addition, looking up the consumer complaint history for relevant insurance companies and online testimonials will reveal how they treat their customers.

There’s no universal insurance option for all clients. Shopping around and working with an insurance agent can help you discover a personalized solution for your unique requirements. Comparing home insurance quotes in Missouri enables you to get the best coverage for the most affordable rate. By taking the time to weigh up your options, you will feel more confident in your decision.

According to U.S. News, Missouri’s average cost of homeowners insurance ranges from $1,700 to $2,500 per year. Your annual premium depends on various factors and will likely increase slightly each year.

With the rising costs of living and high inflation rates, it’s worth looking for ways to save on your home insurance. Use these helpful insights to reduce your monthly premiums.

When your property is a higher risk for an insurance company, you will have to pay more in premiums. Here are some common factors that affect insurance costs:

Speaking to your home insurance broker is the most important tip to help you lower your premiums. They know the ins and outs of each insurance policy, so they’ll know if you are eligible for any discounts. In addition, you may want to try these other tips:

Since 2005, our friendly team has assisted clients in St. Clair, Union and Washington in finding the best insurance policies for their needs. With a comprehensive service offering, David Pope Insurance enables you to insure your home, car, business and life easily.

Establishing long-term client relationships is pivotal to our success. We’re proud to provide over 3,000 clients with superior customer service and have a 98% client retention rate.

Our team understands that all clients are unique, so our mission is to provide flexible and personalized home insurance solutions. We can help you get the right amount of coverage for an affordable monthly premium. But don’t take our word for it — check out the many testimonials from our happy clients.

You’ve worked hard to make your homeowner dreams a reality. Now, choose our comprehensive home insurance solutions to protect your assets against life’s curveballs. Start the process by requesting a quote in under five minutes. Our professional team is ready to tailor our services to your unique needs!

Rick BaileyVery helpful and knowledgeable staff. Answered all my questions in a timely fashion.Always finds me the best rates and coverage.

Robbie BaileyDavid Pope and his son are wonderful people 10 outta 10.

George HodakNever had a bad experience. Every time I have called with a question or update they have been accommodating. Proactively they have contacted us with better insurance ideas.

Philip GerberYour insurance brokerage always finds me the best rates, unlike going with just an agent for an insurance company. When my rate went up with another insurer, you immediately found a better price with a different carrier. The transition was seamless.

Jim ArnoVery helpful with giving me options for insurance. Helped with transition from my past insurance company.

Jonathan MitchellMy home and auto insurance kept going up and my old insurance agency just said that’s the way it is. They saved me about 40% on my home insurance while keeping coverage the same and still saving me money on my auto. VERY happy I made the move.

Kristy HulseyCustomer service is exceptional! Anytime I have a question or need help with anything, whether by phone or email communication, they get back with me promptly and always have an answer. Excellent at finding a way to get the best rate possible as well – which is important!

Travis OwensThe staff is very knowledgeable and the rate I received was excellent. Got BIG savings compared to my last insurance provider.

Yvonne HeinzThe customer service is fantastic and the price is a great value.

Union AmbulanceVery knowledgeable and gets us the best price on insurance.

Justin HulseyI could not be more happy with the service my family and I receive with David Pope Insurance. They are always very helpful and prompt. I highly recommend!

Pauli AnschutzI am very happy with the service my family receives with David Pope Insurance. I highly recommend!

Brandon BealIt has been a great experience. I have received help when needed and have never been bothered with a lot of phone calls or mail/emails. Friendly people doing a good job!

Jaron BondIt was easy and simple to setup my home and auto insurance. No complaints here at all.

Oakley CorbinGreat! I’ve gotten good service and they found me an amazing deal on issuance for both my business and vehicles!

Alan EakerDavid was very easy to work with and get switched over to the new insurance wit great pricing!!

Andrew CapkovicThis guy just keeps saving me more and more money. Last year he saved me 500 dollars on my car insurance alone and a couple hundred on homeowners. I call him because the rates went up on my renewal. Before I could even say anything Zach (guy who answers the phone) says yeah we already found you someone lower. Come in to set up the new provider. The best service for insurance broker I’ve ever had in my life. I guarantee I will never go to anyone else but David Pope insurance.

Jacqueline WardWhen I was reviewing the options for auto and home insurance with coverage for four teen drivers, myself and my husband- David Pope was able to find the best option to craft an affordable plan for our family; no one else even came close to the options this agency was able to design.

Ali KExcellent rates and coverage but that’s just the beginning. The service is absolutely outstanding! Every time I have a question, I get a thorough and prompt response. Every time my coverage needs change, my needs are taken care of immediately. I can’t recommend David Pope highly enough!

Gayle BDavid Pope Insurance Services is a great firm to work with. Very knowledgeable and fast to respond to all of your needs. They had my quotes ready in no time and I was able to sign on the dotted line that same day. Very convenient. I work with David initially, then had the pleasure of working with Zack. Both took great care of my needs. Highly recommend these professionals.

Mary FI have been doing business with David Pope for many years. He’s reliable & absolutely looks out for us every time we need him. He always goes the extra mile. My daughter and my brother also use him & have been satisfied also. I recommend him whole heartedly.

Steve KThis agency is very responsive. Had insurance with one company who substantially raised our home owners rates. They came to me saying they could find a better package rate that would save us money on home and auto. It is a breath of fresh air to have agents who do so without being asked! Further, had a question that wasn’t urgent on Easter Sunday. Sent it via email and received a reply that day. Can’t ask for better than that!

Nicole BMy experience with your company was amazing! From my first call requesting a quote to my most recent call requesting your company to print out our vehicle insurance cards. Employees were always positive, never made me feel rushed, customer service was superb! Thank you for making a new customer to your company feel so welcome!