In general, your home or personal budget is a list of your monthly expenses. As discussed in Chapter 1, listing your monthly household expenses and comparing these costs to your income allows you to see where your money is going and how much you have left to save. This chapter shares a thorough list of personal budget items to help you create a worksheet and keep track of your spending.

If you discover that you need to cut down on expenses, make sure to consider your insurance and how you may be overpaying. At David Pope Insurance, we can help you find home, auto and life insurance that fits into your budget.

Home budget categories typically include monthly income and expenses such as:

Your household’s budget items depend on your unique situation and how you live. To help you get started, here’s a checklist of common budget expenses. Feel free to use this checklist to create your own budget worksheet for your monthly bills:

Include costs related to owning or renting your home, such as:

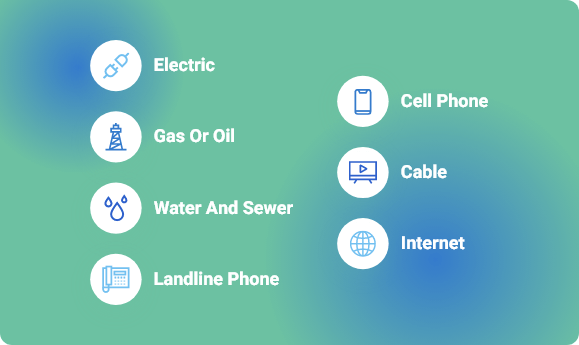

List household utilities and services, like:

Jot down food and beverage expenses, including:

Consider daily living and personal expenses, such as:

List costs related to transportation, including:

List costs related to raising a child, like:

Include costs related to pet care, such as:

Add entertainment costs, including:

List your various savings accounts, such as:

Consider all of your financial obligations, including debt and payments such as:

List any items you regularly buy but do not fit under other categories, such as:

A line item refers to each expense you list in your home budget. Next to each item, enter the amount of money you’ll put towards it from your income.

According to the Family Budget Calculator created by the Economic Policy Institute, a family of two adults and two children can expect to spend about $6,000 a month living in Franklin County, Missouri. You can use this calculator as a budget guideline for a family of four.

The U.S. Department of Agriculture (USDA) also provides budget recommendations for families regarding food expenses. For example, according to the USDA, a family of four on a tight budget can spend around $600 a month on food and still have a nutritious diet. A family of four with a more flexible budget might pay about $1,200 a month on groceries.

A monthly worksheet shows you how to budget household income. If you see how much you’re spending, you can plan for the future better. You’ll discover if you have money left after paying your monthly bills to add to a savings account. You’ll also see if you’re spending more than you’re making and need to cut some expenses.