If you own a small business, you know how important it is to set up as many precautions as possible to protect it. That being said, there are eleven types of insurance policies that may protect your small business in different ways.

Let’s take a deeper dive into insurance for businesses and how they can protect your operations, so you can figure out what type of business insurance you need.

If your business faces a claim that it caused property damage or bodily injury to someone, general liability insurance can help you. For example, if someone slips and falls while shopping in your store, the coverage from this insurance may help pay for any of their medical expenses. Another example would be if someone falls in your store and breaks their phone. General liability insurance may help pay for the replacement costs of the phone.

Your general liability insurance may also include product liability insurance. This type of insurance may help protect your small business against claims that one of your products caused property damage or bodily injury.

If you’re a small business owner, you’ll ultimately need some form of business liability insurance. Sometimes general liability insurance is bundled with property insurance in a business owner’s policy. However, you can also find it as stand-alone coverage. Contact your policyholder if you’re unsure about your existing insurance coverage.

When thinking about what general liability insurance you need, consider your business’ level of exposure. After an accident, you don’t want to be caught with insurance that won’t cover what you need. You should also consider the type of customers or clients your business attracts and what specific risks you might face, such as a retail store that provides medical devices for older adults.

You may even find that it’s required to have general liability insurance when working with certain clients or employers.

Professional liability helps you cover claims regarding mistakes in the professional services your business offers. Let’s say you own an accounting firm and a customer gets charged for a penalty they didn’t need to be charged for. If this customer sues your accounting firm, professional liability insurance will help you cover any legal costs.

This type of coverage is an investment because it can help you save money in relation to claims costs. Sometimes this form of insurance is referred to as errors and omissions insurance.

Professional liability insurance has different names depending on the profession. In the medical field, it’s often called malpractice insurance, and in the real estate field, it’s often referred to as errors and omissions insurance.

Typically, homeowner’s endorsements, in-home business policies and business owner’s policies do not provide professional liability coverage.

This type of insurance only covers claims for the policy period. This means that these insurance policies are typically arranged on a claims-made basis. If an incident that happens before activation of your coverage, it may not be covered.

Coverage under professional liability insurance does not include criminal prosecution. It only includes the legal liability listed in the policy. In this kind of policy, a data breach would not be included. However, you can get separate insurance to cover technology issues.

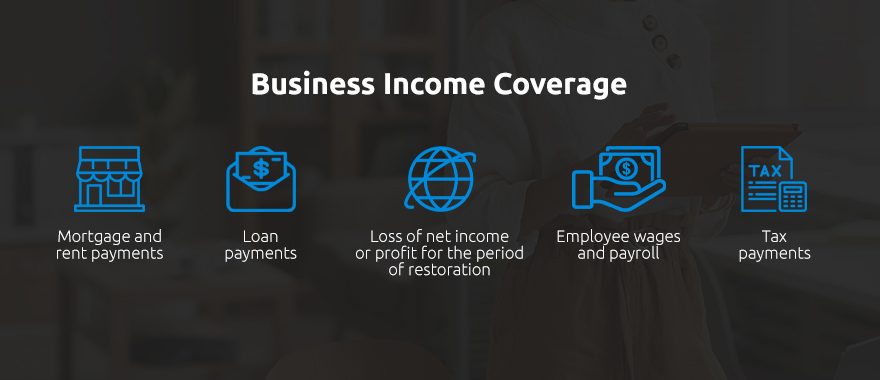

Business income coverage, sometimes known as business interruption insurance, may help your business replace lost income if it’s unable to operate due to covered property damage. For example, if your company faces damage from theft, storms or fires, this insurance may help you replace lost income due to these damages. Below are some common expenses that this type of insurance covers:

Business income coverage excludes acts of war, nuclear hazards and government seizure. Other events that might be excluded under this type of insurance include the following:

If you’re wondering about the cost of business income coverage, it will vary depending on the industry your business is in and where your business is located. For example, if your business is located near the sea and more prone to severe weather, then you may face higher premiums. Another example is how premiums might be higher for restaurants because they’re more prone to fires.

Let’s say your business is broken into and computers and expensive hardware are stolen. Commercial property insurance would help cover the replacement costs because it ultimately protects the owned or rented equipment you use to run your business.

Commercial property insurance policies and rates depend on:

If your employees suffer from a work-related illness or injury, workers’ compensation may provide benefits to these employees. Say you own a small construction business and one of your employees hurts their hand with a poorly maintained drill. Workers’ compensation insurance would provide benefits for this employee.

Most states require this type of coverage for small businesses with employees because accidents can happen at any time in any industry.

Some states do not cover their employees with workers’ compensation insurance, though this varies from state to state. Some states even exclude small businesses from getting coverage and may have different requirements to disburse benefits based on the industry the employee works in.

A person’s full salary is typically more than the salary replacement paid under this type of insurance. Even the best programs will only cover a partial amount of a person’s full salary.

Workers’ compensation benefits aren’t usually taxable at the state or federal levels. If benefits recipients have income from Social Security Disability or Supplemental Security Income programs, taxes may be due.

If injuries are not incurred as a direct result of employment, most compensation plans will not cover medical expenses. For example, if a construction worker got injured on their way to work, their medical expenses would not be covered. However, if they injured themselves by falling from scaffolding, their expenses would indeed be covered.

If a worker passes away due to a work-related incident, workers’ compensation would make payments to their dependents.

Workers cannot sue their employer for negligence if they agree to get workers’ compensation. This is supposed to protect both employers and workers. Workers gain the right to guaranteed compensation in exchange for further recourse and employers avoid negligence lawsuits by consenting to a degree of liability.

Commercial auto insurance may help cover bodily injury or property damage claims if your employee is driving a company-owned vehicle and gets in an accident. If an employee makes a delivery and accidentally hits and damages a mailbox, commercial auto insurance would help pay for the damages to the mailbox.

If your business relies on vehicles to operate on a daily basis, you likely need commercial car insurance. If you’re still considering whether or not you need this type of insurance, think about the following:

The best way to decide whether or not to get commercial car insurance is to speak to an insurance agent. They will explain how your particular type of business, vehicle and vehicle use would benefit from this insurance type.

Data breach insurance helps your small business when personally identifiable information gets stolen or lost. It can help you offer credit monitoring services, launch a public relations campaign or notify impacted clients or customers.

This insurance is also referred to as cyber liability insurance.

Many businesses use the internet and computers to further their progress in their industry. Many companies distribute items and services to their customers through the internet. However, computers can fall victim to data breaches.

Sometimes providing services and items to customers or clients can result in the transfer of private information that may be breached. This information may include Social Security numbers, contact information, health records and credit card details.

If you store or transfer any of these types of information, your business is at risk for a data breach and would greatly benefit from data breach insurance. You don’t want your business to suffer from identity theft attacks!

Commercial umbrella insurance allows you to extend the limits of liability policies you already have. Say the cost of a claim goes over your policy’s limits. Your commercial umbrella insurance may help cover the difference between what your policy covers and what is left of the claims cost. Consider the following details when purchasing commercial umbrella insurance:

Employment-related claims, such as wrongful termination, sexual harassment and discrimination claims, can be protected against through Employment Practices Liability Insurance, sometimes referred to as employer’s liability insurance.

If you’re looking for an insurance policy that combines commercial property insurance, general liability insurance and business income insurance, a business owner’s policy is your best bet. Under this type of policy, crime insurance, flood insurance and vehicle coverage may also be included.

Depending on your business, you and your insurance company may need to make arrangements for additional coverage components listed below:

Hazard insurance for small businesses protects your rented or owned business property. For example, if someone were to damage your building or equipment, hazard insurance would help cover replacement costs.

Hazard insurance typically protects your small business from rainstorms, snow, wind, hail, fires and lightning. Hazard insurance can be a part of your homeowners insurance policy, but this doesn’t help unless you run your business out of your home.

The amount of hazard insurance you require depends on what it would cost to recover your business in case of a total loss. Property value may not come into play during this scenario like you think it might.

These policies are typically limited to an annual period and need renewal.

If you’re insuring a small business, consider coming to David Pope Insurance for help! At David Pope Insurance, we’re dedicated to getting you the lowest rates on the market. We want your cost to be low and your mind to be at peace!

If you want to know more about us and what we can do for you, fill out our online contact form or give us a call at 636-583-0800 for a fast, flexible quote.