The dream of the open road is alluring to many people. How many of us have dreamed about road-tripping up the coast of California or seeing the purple mountain majesties and fruited plains that roll across the country?

Even if we’re only commuting to work instead of carving the curves of Big Sur, America is bursting with drivers. In the United States, 264 million vehicles are registered, and 218 million people hold valid driver’s licenses.

Naturally, this amount of traffic comes at a price. In 2015, 6.3 million car accidents caused damage, injury or loss of life. It’s vital to protect yourself, your vehicle, your loved ones and others on the road by investing in quality car insurance.

The dream of owning a piece of land and a home of one’s own also resonates strongly with many Americans. Many families, young and old, save for years to afford a down payment on a home they can call their own. In this scenario, too, it’s crucial to protect that place of your own with quality homeowner’s insurance. That way, no matter what life throws your way, you know you won’t lose your family’s home to catastrophe.

Life insurance and commercial insurance also play an essential role in our security and peace of mind. Commercial business insurance helps protect small businesses, their owners, and their employees from unexpected events. Life insurance ensures that dependents will be taken care of in the event of the policyholder’s death.

Jump To:

(Jump to Missouri Insurance Info)

Car insurance, homeowner’s insurance, commercial insurance and life insurance have many consistent features no matter what state you live in.

Car insurance rules and policies across different states are similar in many regards. For example, all states require drivers operating a motor vehicle to be financially responsible for accidents up to a fixed dollar amount. Every state except New Hampshire has mandatory car insurance requirements for all residents, though even the “live free or die” state does have these requirements in place for DUI offenders. New Hampshire does require drivers to cover the costs of damages and injuries when they are at fault in an accident, though. Practically speaking, this means many drivers carry car insurance policies.

No matter where you live, the significant numbers in car insurance are always expressed in a format like $50,000/$100,000/$50,000 or 50/100/50. These figures refer to the types of coverage your policy offers you. All states determine their own rules about what levels of liability insurance they require drivers to carry.

The first figure — $50,000, above — refers to bodily injury liability coverage per person. Bodily liability coverage per person refers to the amount that your insurance company would pay to cover the injuries of one person in the other car if you were at fault in an accident. If one person were in the other car, your insurance company would pay up $50,000 toward covering that person’s injuries. If two people were in the other car, your insurance company would pay $50,000 per person toward covering bodily injuries.

The second figure — $100,000, above — refers to bodily injury liability coverage per accident. This means the total amount that your insurance policy would pay toward the injuries of the people in the other car, no matter how many people there were. If you have $50,000 in bodily injury liability coverage per person but only $100,000 in bodily injury liability per accident, your insurance will pay only up to $100,000 toward bodily injuries. This statement is true even if there were four people in the other car, each with injury expenses totaling $50,000.

The third figure — $50,000, above — refers to personal property damage liability per accident. Generally, this number refers to the costs required to repair or replace the other vehicle involved in an accident, though if you plow your car into someone’s living room, your insurance company will pay toward those costs too.

In all states, there are three main types of car insurance coverage: comprehensive, collision and liability only. Learn more from our Comprehensive Guide to Auto Insurance.

A car insurance policyholder must typically meet a standard deductible through out-of-pocket payments before the insurance policy kicks in. A higher deductible typically leads to lower rates and vice versa.

In all states, responsibility for an accident is determined either by tort or no-fault requirements. A tort is a civil wrong that results in harm and legal liability but does not fall under criminal classification.

The broad strokes of homeowner’s insurance are also similar throughout all 50 states.

Unlike car insurance, the law does not require homeowner’s insurance. This is because your home is less likely to injure someone or damage their property than your vehicle is. If you have a mortgage however, your mortgage lender will likely require you to carry a homeowner’s insurance policy. This is because the mortgage lender has a vested interest in maintaining the value of your home so that you don’t default on the loan.

Homeowner’s policies, like car insurance policies, are customizable to meet the specific needs of every individual and family. Generally, they protect against the cost of repairs or replacement in the case of damage to your home or theft of items you own. They also protect you if another person becomes injured in your residence or if you cause damage to a neighbor’s property.

Homeowner’s insurance covers damage caused by unforeseen circumstances such as windstorms, lightning strikes, hail, water damage, explosions, falling objects and fires. It’s important to note, though, that standard homeowner’s insurance does not cover earthquakes and floods. Typically, homeowners purchase separate policies like flood insurance to protect themselves from those events.

Homeowner’s insurance typically consists of a few different types of protection:

Many insurers offer surplus lines of coverage to protect personal property that exceeds the limits of standard homeowner’s protection, such as expensive jewelry, art, antiques or a million-dollar baseball card collection. Firearms also require additional insurance.

As with car insurance, the holder of a homeowner’s insurance policy must typically meet a standard deductible through out-of-pocket payments before the insurance policy kicks in. If your deductible is $3000, your rates are likely to be lower. If your deductible is $150, your rates are likely to be higher. Insurance companies trust that if you must pay higher out-of-pocket costs before receiving any insurance benefits, you are less likely to make frivolous claims. Insurance companies also know that when you have a higher deductible, they will be responsible for a smaller portion of any claims that you make.

In all states, life insurance works to provide for designated beneficiaries, whether a spouse, children or other family members, after the policyholder’s death. Typically, the policyholder pays regular premiums throughout life. If that person dies, the insurance company disburses an agreed-upon sum of money to provide funds for the living beneficiaries’ living expenses, funeral cost burden, education and other expenses.

Life insurance comes in two main types:

Many life insurance policies offer a “free look” period. This means that consumers can try out their new insurance policy, usually for a week to a month, before they make a decision. If they decide they don’t want the policy after all, they can get out of it without charges.

Life insurance policies do not generally differ by state. They typically differ based upon the policyholder’s age, gender and wellness, because these factors correlate much more predictably with a person’s lifespan than their state of residence does.

Commercial insurance typically works by combining property, liability, crime, casualty and commercial auto insurance into a set of basic policies. Businesses can choose other types of coverage to add, such as workers’ compensation and business interruption insurance. Even dental, vision and group life insurance policies for employees fall under the umbrella of commercial insurance, though health insurance for employees does not.

Like other types of insurance policies, commercial insurance policies differ in their rates based on the property’s location, construction and value, the climate and crime rate of the surrounding area and the level of risk involved with the type and size of the business. A small pizza parlor in a safe neighborhood will be relatively inexpensive to insure. A firefighting department in a high-crime area would not.

The average cost of car insurance varies from state to state, but why is this the case? First, it’s essential to understand it isn’t just the state you live in, but the exact city or town, that can affect your rate. Location is a critical factor for several reasons.

Remember, insurance companies determine what to charge you based on a risk-factor analysis of how much you are likely to cost them. People who are more likely to get into a wreck will pay more for car insurance than those who are less accident-prone. We’ll talk more in the next section about personal factors that play into this risk-analysis profile. Here, though, we’re focusing not on the driver but where the driver lives — or, instead, where they drive.

The NAIC found states with higher average premiums tended to also have high urban populations, dense traffic and higher wage and price levels. It’s not difficult to see why some aspects of where you live would affect your rates, but other factors may be less noticeable. Insurance companies factor many complex aspects of your location into setting rates for you and your neighbors, including the following:

Location isn’t everything when it comes to determining your rates. Insurance companies will also analyze statistical information about you to help determine the likelihood that you will file claims. Here are some of the factors insurance companies typically consider when setting your rates:

Based on these factors, there are many ways you can discount car insurance, or at least lower your auto insurance premiums. These include:

Before we look to the future, let’s take a moment to look back. Over the past several years, the average cost of auto insurance has steadily risen for a few different reasons. One is that driving has become more affordable, and there are more drivers on the road because of it. As we’ve already seen, the more drivers there are, the more likely accidents are to occur.

Forbes attributes the rising cost of insurance to three significant factors:

Though insurance companies have steadily increased premiums, they haven’t raised them enough to maintain their profits. As premiums have risen, the cost to cover losses has grown to an even higher degree, meaning insurance companies are still seeing a decline in profits despite raising premiums.

Since the cost of car insurance has risen in past years, you may assume it will continue to do so in the future. However, as we look to the future of auto insurance costs, we must consider the way transportation technology and trends are evolving. One significant development is autonomous technology designed to reduce human error that leads to auto accidents. The consulting firm KPMG predicts this technology could lead to a 90 percent reduction in the frequency of accidents by 2050.

As we have seen, more accidents mean higher costs for insurance companies and, therefore, higher premiums for drivers. So, decreasing the frequency of accidents overall could lead to substantially lower premiums for drivers. Though this is a long-term prediction, car manufacturers are already incorporating some autonomous driving features into vehicles that are currently on the market, so these safety benefits could begin to lower premiums sooner, rather than later.

It isn’t just that autonomous driving might make cars safer by removing human error from the equation. The other major factor to consider is that auto manufacturers would be liable if something went wrong with the technology and caused an accident. That further decreases the risk for insurance companies since they would not have to assume responsibility in these situations.

As auto manufacturers take on more liability, they will likely have to offer product liability insurance in place of traditional auto insurance. KPMG predicts there will be a major shift where product liability insurance will become far more common as personal auto insurance becomes less common. More specifically, they predict the $192 billion in losses that personal auto insurance accounted for in 2017 will decrease to only $55 billion in losses by 2050 — a 71 percent decline.

Another trend that is currently disrupting the auto insurance market and will likely continue to do so is mobility on demand, which includes popular services such as Uber and Lyft. Especially in densely populated areas, mobility on demand is flourishing, and is expected to be worth $200 billion by 2024. KPMG estimates that, by 2024, more travel in cities and surrounding suburbs will be through on-demand services than through the use of a personal vehicle.

Since mobility-on-demand services require commercial auto insurance instead of personal, this trend will cause another shift in the auto insurance industry: a rise in commercial auto insurance and a decline in personal auto insurance. Along with the other changes we’ve looked at, it will contribute to fewer claims and costs for insurance companies, which should lead to lower premiums.

Insurance in Missouri differs from other insurance in a few ways.

In the Show-Me State, as with almost all other states, law enforcement officials expect you to be able to show them proof that you have car insurance. Car insurance, also often called auto insurance, is an essential means of protecting you and other drivers from a sudden financial burden if you get into a wreck.

No one gets into their car expecting to get into a traffic accident, but the reality is that accidents occur every day. Car insurance helps you rest easy knowing that if this unfortunate situation arises, you’ll be able to cover either your or the other driver’s costs, depending on the nature of the incident.

As we’ll see, in Missouri, drivers must have liability insurance to protect other drivers, and uninsured motorist coverage to protect themselves. Many Missourians choose to go beyond these minimum requirements and purchase additional coverage. Other types of coverage include:

Across the nation, in almost every state, the law requires drivers to have auto insurance. However, the exact requirements for what types and amounts of coverage differ from state to state. In Missouri, drivers must have two types of coverage:

In Missouri, driving uninsured is illegal, so if you cannot provide proof of insurance to a law enforcement officer, you will receive a ticket. Though it’s a smart idea to always keep your auto insurance card with you while you’re driving, as of Aug. 28, 2013, Missouri drivers may also use a mobile device to show proof of insurance. If you are convicted of failing to provide any proof of insurance, you will face one of these three penalties:

If your license gets suspended for the first time, you can end your suspension immediately as soon as you provide proof of insurance and pay a $20 reinstatement fee. If your license gets suspended for the second time, the suspension period will last 90 days and can end once you provide proof of insurance and pay a $200 reinstatement fee. Any suspensions you receive after the first two will cause your driving privileges to get terminated for a year and require you to show proof of insurance and pay a $400 reinstatement fee.

While liability coverage is the bare-minimum requirement in every state, some states don’t require uninsured motorist (UM) coverage. Currently, 20 states, as well as Washington, D.C., require uninsured or underinsured motorist coverage. Why do these states, including Missouri, require this type of coverage? About one out of every eight drivers on average across the U.S. is uninsured. In Missouri, the number is slightly lower than the national average — 14 percent, or about one out of every nine drivers in Missouri, is uninsured.

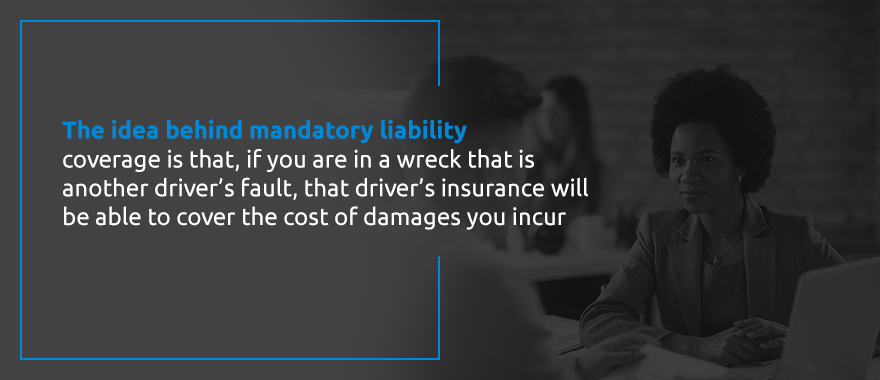

The idea behind mandatory liability coverage is that, if you are in a wreck that is another driver’s fault, that driver’s insurance will be able to cover the cost of damages you incur. However, as we’ve just seen, you can’t count on every driver to have liability insurance. That is where uninsured motorist coverage comes in.

Under Missouri law, you will receive benefits from your UM coverage if an at-fault, uninsured driver causes injury to you or your passengers, or if you fall victim to a hit-and-run. In either of these scenarios, uninsured motorist coverage will cover medical costs and loss of wages if you have to take time off work. If you have the minimum amount of coverage, and your costs exceed $25,000 for you alone or $50,000 if there were passengers involved, you will have to cover the additional costs yourself.

If your policy includes multiple vehicles, you can increase your UM coverage by stacking which would separate the policies. In other words, you maintain the minimum amounts for each vehicle, resulting in more coverage overall. For example, if you have two insured vehicles, each at the minimum limit of $25,000 and $50,000, you end up with a total of $50,000 and $100,000 of coverage. Stacking is optional and only required if you have two separate auto policies. If you would prefer to keep your premiums lower and maintain only the minimum amount of coverage for all your vehicles, you can do that.

In some cases, an at-fault driver may have insurance, but not enough to fully cover your costs. Though Missouri mandates drivers must have a minimum amount of uninsured motorist coverage, the state does not require underinsured motorist insurance. Even though this coverage isn’t mandatory, some drivers choose to add it to their policies because it can help make up the difference between what the at-fault driver can pay and your remaining expenses.

Average car insurance rates vary from state to state across the U.S. We’ll talk about why this is the case in the next section. A variety of factors play into determining car insurance rates, so there is no one-size-fits-all price to expect. However, we can generally look at average costs in each state across the nation. Various organizations have undertaken the task of determining these rates. Two of the most notable studies come from the National Association of Insurance Commissioners (NAIC) and Insure.com.

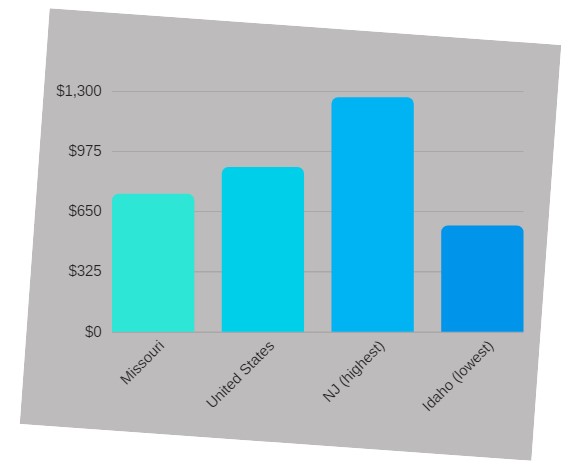

The NAIC’s most recent U.S. auto insurance data comes from 2015. For that year, they found an average insured driver spent $889.01 for the U.S. as a whole. New Jersey had the highest average expenditure at $1,265.69. In Missouri, the average cost was $745.04 — more than $140 below the countrywide average. Because so many factors affect the average cost of insurance in a state, however, the report points out that readers should take direct comparisons between states with a grain of salt.

Insure.com commissioned a study in 2018 that removed some variables to produce a more direct apples-to-apples comparison among states. Rather than adding up and averaging what the total population pays, they determined what the same person would pay in each state. The researchers looked at the average rates from six prominent auto insurance carriers in 10 ZIP codes in each state to see what this hypothetical driver would pay, on average.

This hypothetical driver is a 40-year-old single male who makes a 12-mile commute to work every day in a cheapest-to-insure 2018 model-year version of one of the 20 bestselling vehicles in the U.S. His policy limits are $100,000 for injury liability, $300,000 for all injuries and $50,000 for property damage in an accident, and he has a $500 deductible on collision and comprehensive coverage. According to the study, the national average cost of auto insurance for this driver was $1,365 for a year of coverage.

You might notice right away this cost is higher than the national average the NAIC determined for its study. This discrepancy may be due in part to the difference in methodology, but it’s also crucial to note the cost of auto insurance has steadily risen, which could also account for an increase from 2015 to 2018. From 2012 to 2017, the consumer price index (CPI) for auto insurance increased by 21.5 percent, while the overall CPI only increased by 4.5 percent.

The Insure.com study ranked states based on the averages they determined. Michigan tops the charts with the highest average annual insurance rates in the country at $2,239.

What’s the Average Cost of Car Insurance in Missouri?

In Missouri, the average cost was $1,256 — more than $100 lower than the national average. Both studies demonstrate Missourians have the good fortune of paying less for insurance than many other Americans.

In Missouri, home insurance typically costs more than the national average. The median homeowner’s policy in the United States comes out to $1,098 a year. Missouri comes in at number 17 on the list of states, with an average homeowner’s insurance premium of $1,280. As with car insurance, though, many factors influence a homeowner’s insurance premium, including the age of the home and its roof, the crime level of the neighborhood, the construction materials used for the home and the existence of extra structures like in-ground swimming pools.

Studies show that insurance companies collect substantial premiums in the state of Missouri — and also make substantial payouts to insured individuals. Property and casualty insurance companies do $11 billion worth of business a year in Missouri, and life and health insurance companies do $14.8 billion. Yearly payouts for property and casualty insurance and casualty total $6.7 billion, and life insurance payouts total $9.6 billion.

Midwest insurance must often take severe weather into account. Commercial, homeowner’s, auto and life insurance are especially important in Missouri when natural disasters strike. For example, when tornadoes touched down in Joplin, Missouri, in 2011, property owners reported $7.3 billion in insured losses. Individuals reported 158 fatalities and 1,000 injuries in the aftermath of that natural disaster, and Missouri life insurance made the future a little less burdensome for families dealing with heavy losses.

Homeowner’s, commercial and comprehensive auto insurance policies provide vital pieces of protection against devastating losses in the event of natural disasters like this. Life insurance policies also provide financial stability for loved ones in the case of the worst outcome.

With its long, hot summers, Missouri is also home to outbreaks of wildfire, ranking seventh out of the 50 states in 2016 with fires that burned upward of $32,000 acres. With its flatlands and broad, deep rivers, Missouri also tends to flood in the spring. For this reason, home and business owners will want to consider extra flood insurance in addition to their Missouri commercial insurance and homeowner’s insurance for added protection.

Because of the well-known risks of natural disasters in the Show-Me State, premiums for various types of insurance can be higher than in other areas of the country, though rates will vary with specific circumstances. Potential policyholders will need to weigh the price of policies against their protection and peace of mind and decide what levels of coverage are right for them.

Insurance in Arkansas differs in a few ways.

In Arkansas, as in most other US states, the law requires car owners to carry auto insurance policies. This law is in place to protect all drivers on the road from the financial devastation that could result from a severe accident. Car accidents are just as common in Arkansas as in other areas of the country, so having the minimum levels of policy coverage proves that you will be responsible in the event of an at-fault accident.

Failure to carry the required level of liability coverage in Arkansas results in a fine of up to $500 and potential jail time of up to three months. Repeated offenses incur steeper fines of up to $3,000, jail time of up to six months, and potential suspension of the offender’s license and registration.

Arkansas is a tort liability state for car accidents. The driver determined to be at fault in an auto accident will be required to pay repair and injury costs for the other driver. Arkansas is an add-on state, however. This means that the state adds some of the benefits of no-fault states to the traditional liability system. Drivers can receive compensation from their own insurance policies as they would from others’ in a no-fault state, though the benefits may be lower than in true no-fault states.

In Arkansas, according to the most recent figures, the average premium for minimum liability coverage was $394.13. This amount is significantly lower than the United States average of $538.73. For all types of Arkansas car insurance, the average premium comes to $736.43, still below the national average of $889.01. For comparison purposes, remember that the state of New Jersey’s car insurance premiums come in at the highest in the country with an average cost of $1,265.69, whereas Idaho’s car insurance premiums come in at the lowest in the country, with an average cost of $573.83.

One major factor affecting the lower cost of Arkansas auto insurance premiums is the fact that in comparison to many, Arkansas is a relatively rural state. Accordingly, the density of traffic on Arkansas roadways is less than in many other states. Per year, Arkansas motorists drive just over 331,000 vehicle miles per highway mile — compare that number to the figure in California, where motorists drive a whopping 1,450,000 vehicle miles per highway mile.

Additionally, the vehicle theft rate in Arkansas is somewhat lower than average. In Arkansas, thefts claim an average of 2.09 motor vehicles for every 1,000 motor vehicles registered. This figure falls appreciably below the national average of 2.74 motor vehicles stolen per 1,000 vehicles registered. Thus the lower traffic density and vehicle theft rates in Arkansas provides fewer opportunities for car accidents. This fact assures insurance companies that they are taking less risk in insuring an Arkansas driver. Rates will vary, of course, across different areas of the state and depending upon an individual’s driving record and history of insurance ownership.

In Arkansas, the minimum liability coverage figures for car insurance are $15,000 bodily injury liability per person, $30,000 bodily injury liability per accident and $10,000 property damage liability per accident.

In Arkansas, home insurance can be expensive. The average homeowner’s insurance premium vastly exceeds the national median of $1,098, ranking 13th in the nation at $1,348 per year.

The high incidence of extreme weather, particularly thunderstorms and tornadoes, contributes dramatically to the higher homeowner’s insurance premiums in the state of Arkansas. Wildfires and flooding also visit the state regularly and can lead to higher rates as well — for Arkansas commercial insurance, life insurance and homeowner’s insurance.

Because Arkansas has only about half the population of Missouri, insurance companies’ written premiums in Arkansas total to less than they do in Missouri. Property and casualty insurance companies do $4.9 billion worth of business a year in Arkansas, and life and health insurance companies do $4 billion. Yearly payouts for property insurance and casualty total $3.4 billion, and Arkansas life insurance payouts total $2.8 billion.

Insurance in Kansas differs from insurance in other states in a few ways.

In Kansas, as in most other states, drivers are required to carry liability insurance policies to protect other people from devastating losses and injuries in the event of a car crash. Failure to carry the required level of liability protection leads to fines of between $300 and $1,000 and potential jail time of up to six months. Repeat offenses incur steeper fines of between $800 and $2,500, and they can ultimately lead to suspension or revocation of the offender’s license.

Kansas is a no-fault state. Instead of following the traditional rules of at-fault liability and insurance payout, Kansas law requires all drivers to file claims with their own insurance companies regardless of who was at fault in the accident. Drivers must purchase personal injury protection (PIP) for their vehicles to protect themselves in case of an accident.

In Kansas, according to the most recent figures, the average premium for minimum liability coverage was $358.24. This amount is significantly lower than the United States average of $538.73. For all types of car insurance, the average premium in Kansas comes to $698.45, still below the national average of $889.01.

As with Arkansas, one main factor affecting the lower cost of Kansas car insurance premiums is the fact that Kansas is a relatively rural state. Accordingly, the density of traffic on Kansas roadways is lower than in many other states. Per year, Kansas motorists drive just over 218,000 vehicle miles per highway mile — much less than the national average of 724,000 vehicle miles per highway mile.

Additionally, Kansas boasts an impressively low vehicle theft rate, with a yearly average of 2.09 motor vehicles stolen per 1,000 vehicles registered. This figure is lower than the national average of 2.74 motor vehicles stolen per 1,000 vehicles registered.

The lower traffic density in Kansas provides fewer opportunities for car accidents. This fact assures insurance companies that they are taking less risk in insuring a Kansas driver. As in other states, specific rates for Kansas auto insurance will vary based on other factors, such as where the car is garaged and the driving record of the policyholder.

Even though Kansas is a no-fault state, drivers must still carry minimum liability insurance by law. In Kansas, the minimum liability coverage figures for car insurance are $25,000 bodily injury liability per person, $50,000 bodily liability per accident and $10,000 property damage liability per accident. Additionally, Kansas law requires drivers to carry $25,000 uninsured/underinsured motorist coverage per person and $50,000 uninsured/underinsured motorist coverage per accident.

In Kansas, home insurance can be expensive. The average homeowner’s insurance premium vastly exceeds the national median of $1,098, ranking fifth in the nation at $1,548 per year.

As in some surrounding states, extreme weather plays a prominent role in this price discrepancy. Kansas, famous for its severe, at times devastating tornadoes, gives insurance companies reason to believe they will have to cover high damage costs for residential properties.

Severe weather can affect Kansas commercial insurance, auto insurance and life insurance payouts as well, though Kansas’s small population means the numbers remain modest.

Property and casualty insurance companies do $6.2 billion worth of business a year in Kansas, and life and health insurance companies do $8.9 billion. Yearly payouts for property insurance and casualty total $3.1 billion, and Kansas life insurance payouts total $4.1 billion.

Insurance in Iowa differs from insurance in other states in a few ways.

As in other states, Iowa drivers need to carry minimum liability coverage to remain compliant with the law. Driving in Iowa while uninsured typically results in a fine of $250 or court-mandated community service. In addition, a police officer issuing a ticket for a first uninsured driving offense can immediately confiscate the driver’s plates and registration and impound the vehicle.

In Iowa, according to the most recent figures, the average premium for minimum liability coverage was an exceptionally low $299.18. This amount is significantly lower than the United States average of $538.73. For all types of Iowa car insurance, the average premium comes to $599.03, well below the national average of $889.01.

Like many of its neighbors, the state of Iowa is relatively rural. Accordingly, the density of traffic on Iowa roadways is lower than in many other states. Per year, Iowa motorists drive just over 275,000 vehicle miles on the road per highway mile — much less than the national average of 724,000 vehicle miles per highway mile.

It is also true that Iowa has one of the lowest vehicle theft rates in the country, with only 1.22 thefts per every 1,000 registered vehicles. Only seven states in the nation — Idaho, Maine, New Hampshire, South Dakota, Vermont, Virginia and Wyoming — have lower rates of vehicle theft.

Thus, the lower traffic density and low crime rate in Iowa provide fewer opportunities for car accidents and motor vehicle thefts. These facts assure insurance companies that they are taking minimal risks in insuring an Iowa driver. Iowa auto insurance is a safe bet for insurance underwriters.

In Iowa, the minimum liability coverage figures for car insurance are $20,000 bodily injury liability per person, $40,000 bodily injury liability per accident and $15,000 property damage liability per accident.

In Iowa, home insurance is less expensive. The average homeowner’s insurance premium ranks below the national median of $1,098, coming in 38th at $945 per year. Though tornadoes and severe thunderstorms occur in the state, their occurrence in Iowa is not as widespread as it is in the heart of Tornado Alley. Additionally, as we have seen with the statistics about motor vehicle theft, the crime rate in Iowa is exceedingly low. The low crime rate leads insurance companies to see homeowner’s insurance in Iowa as a safe bet.

Iowa commercial insurance, like homeowner’s insurance, is relatively inexpensive to buy because of favorable conditions in the state.

Property and casualty insurance companies do $6.3 billion worth of business a year in Iowa, and Iowa life insurance and health insurance companies do $19.3 billion. Yearly payouts for property insurance and casualty total $3.1 billion, and life insurance payouts total $7.2 billion.

Insurance in Illinois differs from insurance in other states in a few ways.

In Illinois, as in other states, drivers need to carry minimum liability insurance to comply with the law and protect other travelers in the case of a car accident. Driving while uninsured in Illinois incurs a fine of more than $500, though the fine can be reduced in certain circumstances, and a three-month license suspension even on the first offense. Continued repeat offenses result in fines of $1000 and repeated license suspensions.

In Illinois, according to the most recent figures, the average premium for minimum liability coverage was $446.72. This amount is modestly lower than the United States average of $538.73. For all types of Illinois car insurance, the average premium in Illinois comes to $803.64, slightly below the national average of $889.01.

Like some of its neighbors, the state of Illinois contains significant rural swaths, though the large, dense city of Chicago provides a stark contrast to more rural areas. The density of traffic on Illinois roadways is moderately lower than average for the United States. Per year, Illinois motorists drive just over 719,000 vehicle miles on the road per highway mile — just under the national average of 724,000 vehicle miles per highway mile.

In contrast with Iowa, Illinois has a modestly higher vehicle theft rate of 1.74 stolen vehicles per 1,000 vehicles registered. That figure, however, lands well below the national average of 2.74 motor vehicle thefts per 1,000 vehicles registered.

Illinois auto insurance rates are likely to vary substantially based on the population density where the car is garaged.

In Illinois, the minimum liability coverage figures for car insurance are $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident and $20,000 property damage liability per accident. Additionally, the state of Illinois requires $25,000 uninsured motorist coverage per person and $50,000 uninsured motorist coverage per accident.

In Illinois, home insurance is about average. The average homeowner’s insurance premium ranks slightly below the national median of $1,098, ranking 28th at $1,042 per year. Severe weather, though possible, is not as devastating a feature here as in other states. Additionally, though high crime rates exist in dense urban areas, the crime rate throughout the state is relatively low.

With a population about twice that of Missouri, Illinois sees insurance transactions totaling much higher amounts. Property and casualty insurance companies, including Illinois commercial insurance and homeowner’s insurance companies, do $24.3 billion worth of business a year in Illinois. Illinois life insurance and health insurance companies do $26.6 billion. Yearly payouts for property insurance and casualty total $13.5 billion, and life insurance payouts total $18.9 billion.

If you’re looking for auto, commercial, homeowner’s or life insurance in Missouri or surrounding states, look no further. Our knowledgeable, friendly agents know that insurance quotes are important to help you plan and budget. They will be happy to review the specifics of your vehicle, home, business property or medical history. They can then make an informed recommendation about the type of insurance you need and what it will cost.

Learning about auto insurance averages can be enlightening, but it doesn’t tell you exactly what you’ll pay. If you live in Washington, Union or St. Clair, Missouri or states like Arkansas, Iowa or Kansas and are looking for the right insurance brokers to help you find the perfect auto insurance policy for you, consider David Pope Insurance Services, LLC. We have more than 20 years of experience and have developed valuable relationships and gained a wealth of expertise to help us serve you well. Contact us for a free same-day quote today.