Before you move forward with purchasing a home, be sure you take the crucial step of checking for insurance claims. If a home has a history of claims from previous owners, you may want to proceed with caution in the purchasing process. Does the history of claims on the house make the purchase riskier? Or does it give you leverage to negotiate a better price?

When it comes to buying a home, checking for claims can help you determine whether you want to move forward with the purchase. Learn about home insurance claims and when they might signal a red flag.

More Insurance Tips:

Home insurance matters because it protects one of the most valuable investments a person can have. A house is a large purchase, and home insurance helps protect this valuable asset in case of accidents or damage. Without adequate homeowners insurance, you may be unable to repair your home to its previous condition after it’s damaged or rebuild after a total loss. Homeowners insurance also typically covers more than your home’s physical structure, enabling you to obtain coverage for other structures, personal property and more.

Preparing for undesirable situations with adequate home insurance changes everything. Accidents, natural disasters and burglaries sometimes happen. Home insurance prepares homeowners to handle the worst-case scenario financially. With homeowners insurance, you have peace of mind that your home is protected in various unexpected situations, from fire damage to a burst pipe.

Many lenders also require homeowners insurance before providing a loan. Lenders want their financial investments to be protected. Thus, banks or other lenders may not offer a mortgage or home financing until they receive proof that your home is adequately insured.

It’s important to remember that homeowners insurance involves several different expenses, including your monthly premium and deductible. Plans that cover more will likely have higher premiums. Home insurance plans also vary in their deductibles, which is the amount homeowners must pay out of pocket before their policy kicks in to help cover a claim.

Get a Free Homeowners Insurance Quote!

Home insurance claims tell your insurance what kind of damage, loss or injuries occurred because of an incident so they can use your coverage policy to determine how much of the expenses to reimburse. Here’s how the homeowners insurance claim process works:

You should keep a few more points in mind before filing a home insurance claim:

The most common claims for home insurance are theft, property damage and weather damage. If a house you’re interested in purchasing has a history of home insurance claims, they are likely to be in one of those three areas. Here’s an overview of each of the most common causes of loss:

According to the Insurance Information Institute, theft only accounted for 0.6% of homeowners insurance claims in 2020. The low rate of loss from robberies and break-ins is likely due to the popularity of home protection services like security cameras and video doorbells. These efforts go a long way in deterring potential burglars.

However, the average home insurance claim for theft was significant, averaging $4,415. While that amount is relatively low compared with the cost of other types of damage, insurance helps reduce the burden on the homeowner.

Non-theft property damage refers to vandalism, malicious damage and accidents that result in property damage. This type of loss might include water damage from a burst pipe or leaking washing machine, a vandalized house and more. Water damage and freezing equal 19.9% of home insurance losses, and other kinds of property damage add up to 7.9% of losses.

Damage from storms and bad weather is the number one cause of home insurance claims, with 45.5% of losses resulting from wind and hail. Weather damage also includes lightning. This kind of loss comes from tornadoes, hurricanes and other large storms that break glass windows, damage roofs and cause other problems with the structure of homes. Of all loss categories, fire and lightning were the most expensive, averaging a little over $77,000 per claim.

Purchasing a home that has a history of insurance claims can cost you. In fact, you may be denied when you try to obtain an insurance policy on the home because of previous claims, even for issues that the owner decided to take care of themselves.

In some situations, a homeowner may discover a small issue and make a call to their insurance agent to determine whether they should file a claim. The insurance agent may open a claim file to handle the homeowner’s repair. After discussing with their insurance agent, they decide against filing a claim and opt to make the repair themselves, especially if they recently filed a claim for a major repair.

When the homeowner is discussing the property with you, they may let you know about the major repairs for which they made an insurance claim, but they may not inform you about smaller repairs they made since it’s been fixed and they used their own money.

However, when you attempt to buy an insurance policy, you’re denied because of the number of claims the seller has made — both the claim for the major repair and the “claim” for the smaller repair. A small repair may be marked as a claim, even though the homeowner funded the repair.

Though some states have laws preventing inquiries from being marked as claims, not all do. This can lead to a homeowner struggling to sell and a buyer struggling to purchase home insurance.

Have Questions? Contact Us Today!

The good news is you don’t have to rely solely on a seller’s transparency to learn about all of a home’s insurance claims. Insurance claim records are available from insurance providers who use a Comprehensive Loss Underwriting Exchange (C.L.U.E.) database. Insurance carriers can use this database to retrieve information about claims filed within the past seven years, including damage reports of repairs that the owner made on their own.

With a home insurance claims history report, you can determine if a property carries more risk than you’re willing to take on and confirm whether all repairs were completed properly.

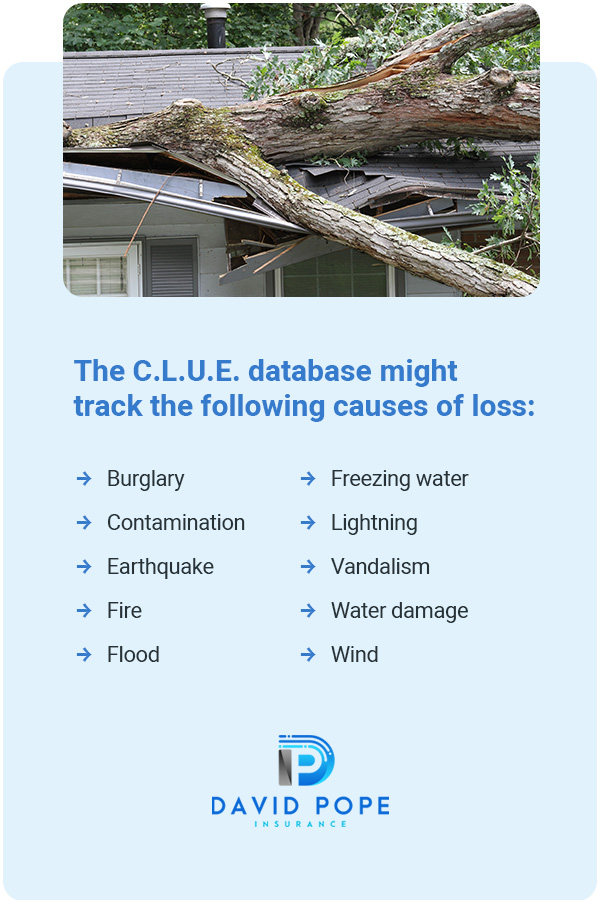

The C.L.U.E. database might track the following causes of loss:

At the beginning of the sale, you can ask that the seller provide you with a C.L.U.E. report. If a seller is willing to provide you with a C.L.U.E. report, this is a sign they aren’t trying to hide anything from you. You’ll feel more comfortable moving forward with the purchase, and the seller will demonstrate that they are prepared and trustworthy.

If no claims have been filed for your dream home in the past five years, you can rest assured that you won’t have to struggle for home insurance availability and affordability.

You may also be able to use the claims history to negotiate a lower price for the home. For example, if the home was robbed in the past, you can inquire about whether new locks have been installed and whether the alarms work. If not, you can use this information to get a lower purchase price.

Managing your home insurance claims requires careful thought and planning. It is appropriate to make a home insurance claim if, after consideration of the incident, you determine the cost of the repairs would be too much to handle on your own. It’s generally best to pay out of pocket for repairs that would cost less than the amount of your deductible. Otherwise, these smaller repairs could drive up your insurance premiums.

Your own home insurance claims can impact your ability to insure a new or second home. To keep your number of claims and insurance premium low, consider the following tips:

If you already have too many home insurance claims, you may still be able to save on home insurance with these strategies:

Homeowners sometimes make costly mistakes when managing their homeowners insurance policies. Fortunately, being aware of the consequences of certain actions can help you bypass mistakes. Here are a few common problems with home insurance claims to avoid:

Communicating poorly about your home’s damage during a claim report can draw out the process of settling the claim and finishing repairs. Be as clear as you can when filing a claim, and include photos of the damage if possible.

A home inventory is a list of the possessions in your and their value. This beneficial document can make the home insurance claims process easier by giving you an itemized list of your valuables. This makes it easier for insurance companies to know how much money you need to replace these items. To make a home inventory, go through your house and take a list of all your possessions, from large furniture and electronics to kitchenware.

Failing to understand your home insurance policy can lead to high expenses later. It’s vital that you understand what incidents your policy covers so you aren’t disappointed and frustrated if you aren’t covered for a specific type of loss. Be sure to read your home insurance policy carefully and call your agent if you have any questions.

The sooner you file an insurance claim, the faster you can repair your home. Waiting can also be a mistake if you clean your house before documenting all the damage.

One of the most common home insurance mistakes is not having enough coverage for a particular incident. For example, a policy might only pay for the actual cash value of damaged possessions rather than the replacement cost, which could be too low to replace your lost items. Speak to your insurance agent before a loss occurs to determine your policy’s exclusions and make any adjustments.

If you’re looking for a family-owned, local home insurance provider in Union, Missouri, look no further than David Pope Insurance Services, LLC. We understand that our clients have different insurance needs, which is why we aim to be flexible in the coverage terms we offer. Our flexibility has enabled us to be considered among the most respected insurance providers in Missouri, Iowa, Kansas and Arkansas.

No matter what your unique situation is, we can figure out how to get the right coverage for you at the best premium possible. For your home insurance policy, trust a provider with more than 20 years of experience. At David Pope Insurance Services, we provide families and individuals with insurance policies that will keep them safe and protected. Finding the insurance policy for you is simple and easy when you work with us.

To learn more about your insurance options or request a quote, contact us at David Pope Insurance Services today.