Life insurance is one of the best ways to ensure your loved ones are protected and financially taken care of when you pass away. Numerous factors affect life insurance costs, including your health, age and lifestyle. To help you understand what might impact your eligibility and policy rates, it’s helpful to understand some of the factors insurance companies typically look at when considering you for a policy. It’s also important to consider reviewing your life insurance policy after these key moments.

Here are 12 factors that can affect life insurance costs:

One of the biggest factors to influence the cost of your life insurance policy is your age. The younger you are, the less you’ll likely have to pay for life insurance. This is because younger policyholders are less of a risk for insurance companies to insure. Older policyholders are less likely to outlive their policy or pay for a permanent life policy before death, so younger applicants often get lower rates.

While age isn’t the only determining factor, starting a life insurance policy sooner rather than later can help you save money on your current premium. Note that your premium will rise as you age with certain policies, though. Buying a life insurance policy in your 30s will help the cash value of your policy grow, so it’s worth considering.

Generally, women will pay less for a life insurance policy than men because the life expectancy for women is over five years longer than men’s. Because women are statistically more likely to live longer than men, they’re typically given better rates.

Insurance companies use your height and weight to help determine your health and what your risk of developing a life-shortening condition is. Some health conditions related to your body mass index (BMI), like heart disease, high blood pressure and Type 2 diabetes, are considered risky to insure because they could lead to an early policy payout. Many insurance companies will consider your BMI when determining your risk, though this method isn’t always reliable.

BMI uses a person’s height and weight to calculate their body fat. However, in some cases, a person’s weight can be misleading. For example, someone with a lot of muscle may have a higher body weight because of their muscle, though that doesn’t necessarily mean they’re at risk of having health problems.

Many insurance companies are aware of the occasional inaccuracy of the BMI system and use their own “build charts” to assess your health instead. These charts vary from insurer to insurer since there’s no official system or calculation, though they tend to be more lenient than those using BMI calculations. If some insurance companies are offering you high policy rates because your BMI indicates you’re overweight, consider looking for an insurer with their own build chart. Many applicants can secure more competitive rates through some insurers’ build charts.

Because your health has such a significant impact on your risk of death, it’s another of the biggest determining factors in the cost of your insurance policy. Since healthier people have a lower risk of dying during an active policy, they’ll typically receive lower premiums. To determine the risk of your medical history and health, insurance companies will often have applicants take medical exams. Your medical exam will look at nicotine use, past illnesses, prescription drug use and other factors.

Another significant factor these assessments look at is chronic illnesses. Respiratory concerns, high blood pressure and high cholesterol are all examples of chronic illnesses that can affect the cost of your life insurance policy. Your medical history, including past and current health problems, can increase your premium.

If you don’t want insurance companies looking into your medical history or know it won’t help your premium, some insurance companies offer life insurance policies without requiring a medical assessment. However, these types of life insurance policies typically have significantly higher costs because the insurer asks for less information. While these policies may work for some people, if you’re trying to find the most cost-effective policy, look for a life insurance company that offers multiple types of life insurance policies and can help you find the best policy for your situation.

Even if you’re cleared of risky medical conditions, your family’s medical history can play a role in your life insurance rates.

Life insurance companies consider your family’s health history because some health conditions can be passed on genetically. Family history can give insurers an idea of the health conditions you may face. They’ll then use that health information to determine your coverage and rates. For example, if there is a history of liver disease in your family, your premium may increase because you have a higher risk of developing the same condition.

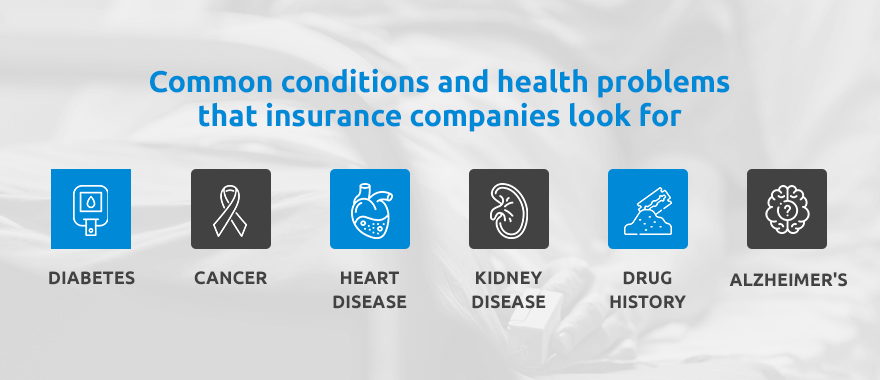

There are numerous conditions and health problems that insurance companies look for. Some common ones include:

Conditions like these are commonly linked to genetics, which means if a close family member has the condition, you’re at risk, as well. Most insurers will look most closely at your immediate family members, like siblings and parents, and consider their health history when determining the cost of your life insurance policy.

If your family history is complex or there are areas of concern, it’s best to be upfront with your insurance company so they can help you find the best policy and coverage. If your insurer is unable to provide an affordable policy that works for your needs, consider looking for more lenient policies and more flexible life insurance companies.

Because of the high-risk health conditions associated with smoking, vaping and tobacco, even if only used on occasion, the use of these substances can potentially increase your life insurance rates.

The same is true of marijuana use, whether you use it for medical or recreational reasons. As marijuana use is legalized in more states, some insurance companies have become more lenient in terms of coverage and policies regarding marijuana use, though it still may affect your policy rates and coverage.

All else being equal, non-smokers receive lower rates and better coverage, which can serve as a great reason to quit using substances like this. Even if you were using these substances when you purchased your life insurance policy and have since quit, your policy rates can decrease. If you no longer smoke or use tobacco products, be sure to communicate with your insurance company to find out when you’ll be eligible for non-smoker rates.

Some jobs, while crucial to society, are considered riskier than others because they have the potential to impact your health and safety. High-risk occupations may include:

Because jobs like these are risky positions to be in, people in these careers may find it challenging to get life insurance policies, and when they do get them, the rates are often high.

Insurance companies will be interested in your occupation if it puts you on the line every day. Insurers will also consider whether your position could lead to the development of a health condition. For example, miners are at higher risk of contracting respiratory conditions because of the daily exposure to dust and particles in the air. If your occupation exposes you to substances that are harmful to your health or involves dangerous duties, your life insurance is likely to cost more.

Your hobbies and other lifestyle factors can also impact the cost of your life insurance policy. Just like certain occupations, some hobbies are considered risky and can increase your premium.

Many adventurous activities like rock climbing, dirt biking, racing, sky diving, flying planes and scuba diving offer exciting thrills and crazy stories. However, participating in these types of hobbies can be risky for insurance companies to cover because they’re potentially dangerous situations and can result in premature payouts.

Participating in these activities once or twice for the experience likely won’t affect your premium or coverage. However, they can impact your policy rate and eligibility if you partake in risky activities regularly.

In addition to your hobbies, life insurance companies will also look at aspects of your lifestyle. For example, many insurers will ask about your financial history and criminal records. Financial history shows your ability to make payments on your policy. Insurers often look for things like bankruptcies and may decline you coverage if you had to file for bankruptcy within a recent timeframe. Some insurers also look at credit scores and may consider low scores to be too risky to insure.

Criminal records can have a significant impact on both your policy rate and your eligibility to get coverage. Many life insurance companies have wait periods following a discharged felony. The length of time since your conviction and whether you’re still on probation can impact your chances of getting a life insurance policy or a good rate. Be upfront with your insurance agency to find out what your options are.

Your driving record can also indicate signs of risky behavior that insurance may increase your rates for. If your driving history shows reckless driving convictions, DUIs, a suspended license and other risky driving behaviors, the cost of your life insurance policy may be higher than without. Keep in mind that insurers are looking for factors that could lead to early payouts, so factors like your driving record are relative.

To be more specific, one or two speeding tickets likely won’t be enough to affect your eligibility, though a pattern of reckless driving is a sign that your driving behavior is risky to your safety.

Another key factor in determining the cost of your life insurance policy is the type of policy you apply for and how much coverage you get. Policy types can vary from insurer to insurer, and many offer customizable policies, so it’s important to understand the policy you’re paying for.

There are several types of life insurance policies, and the main differences between each one are the cost of the premiums and how much the payout is. Consider these three common types of life insurance:

Every life insurance policy has its pros and cons, and there’s no one-size-fits-all policy. Consult with your insurance provider to determine the best policy for your needs and budget.

Permanent life insurance policies will cost the most because you’re paying for life-long coverage. While term life insurance policies are more affordable in many cases, keep in mind that the length of the term can affect the cost of your premium.

There are many lengths of time that you can have a term life policy for. For example, a 30-year term policy will cost more than a five-year term policy because you’re paying for the length of time.

Keep this in mind when purchasing a short-term policy. Be sure to consider whether you’ll end up renewing the policy or extending it, which could mean you’d be paying more over time than if you’d purchase a long-term policy to begin with.

The amount of policy you purchase refers to the death benefit. The death benefit is the money your beneficiaries will receive when you die, as long as the policy is active when that time comes. Your death benefit can range from a couple thousand dollars to a couple million. More coverage comes at a higher premium.

Because life insurance companies use so much information to determine policy costs and eligibility, each company will have its own rating system with classifications. The classes are typically ranked by how preferable applicants are for life insurance.

It’s important to remember that these general pricing factors are just that — general. Insurers consider each applicant’s information carefully to determine an accurate and fair rate.

After receiving your application for life insurance, insurers will consider the information provided, check with third-party sources and place you in classes similar to these:

Overall, being honest and upfront with your insurance company is crucial. Doing so allows them to find you the best policy, coverage and rates for your needs. Keep in mind that insurers work hard to verify all your information, and misleading them can result in a denied application. With the right insurance company to help you, nearly anyone can find a policy.

Even though life insurance can be complicated and isn’t something you want to think about needing, it’s crucial to have so you can ensure your loved ones are cared for after your passing. You need a comprehensive yet affordable policy, and David Pope Insurance can help you find it. With more than 20 years of experience, we are creative and flexible so we can find you what your family needs.

We help various types of families gain peace of mind by preparing for the worst. Contact our team for a free life insurance quote today.