Has your roof recently been damaged by a major storm or natural disaster? The aftermath of a severe storm can be a stressful time for homeowners. After ensuring that your property is safe for you, your family and your guests, you may want to start making a home insurance claim. As a homeowner, understanding an insurance claim for roof damage is essential.

Jump To:

If your roof has been damaged, what should your first steps be? What roof damage is covered under your homeowners insurance? When storms damage your roof, file a claim with photos of the damage. Your policy should cover repairs, as long as wear and tear isn’t the cause. An inspector will assess the roof to determine payout.

After a natural disaster, roof damage can occur. Your first step should be to assess your roof’s condition as soon as possible. You may notice issues like leaks, damage to your shingles or even hail damage to the roof. Speak with your insurance adjuster or review your homeowners insurance policy to determine the requirements for how long you need to wait after a natural disaster or severe storm to have your roof repaired or restored under your homeowners insurance roofing policy. Insurance adjusters inspecting roof damage look for signs like missing or cracked shingles, water damage below, or flaws that indicate wear over time. Understanding their process helps with smooth home insurance claims.

You might be asking questions like, “After how much roof damage should I make an insurance claim?” or “What visible damage should you look for after a natural disaster or storm? The following are a few examples of visible damage you may be able to uncover by examining your roof:

After a severe storm, such as a tornado or hurricane, the damage to your roof may necessitate the complete replacement of your roof. For example, if a tree falls on your roof, this could result in significant structural damage. Whether you notice any visible damage right away, you may want to mitigate potential problems as soon as possible for your future roof claim.

Explore Home Insurance Options

To reduce potential roof issues, you can place tarps on your roof and check for mold and water damage that could result in problems in the future.

If you notice any visible signs of roof damage, you may want to contact a reputable contractor who can inspect your roof. It’s common for contractors to find temporary repairs that need to be done to help prevent further damage. If this is the case, be sure to save the receipts so you can submit them for reimbursement from your insurance company later.

Even if you do not spot any visible signs of roof damage, it is still important to get your roof inspected following a significant weather event, as severe weather can cause underlying damage to your roof. Several potential issues can only be uncovered by an experienced roofing professional. As such, you may want to schedule a roof inspection after a natural disaster or a major storm. Regardless of how reputable a contractor is, avoid signing contracts or paperwork with the contractor before your claim is approved through insurance.

To help support your insurance claim, you can document as much damage as possible. But you may also want to document your property before a storm damages your roof. The more documentation you can obtain, the more evidence you will have to support your claim. This may also make your insurance claim process faster and help your insurance adjuster with their roof inspection. You can document everything by taking photos and videos of your property.

Part of your documentation may be taking notes. When you’re with the claims adjuster or at any point during the insurance or repair process, jot down notes, questions or anything you may want to bring up during future communications. Asking questions and taking notes help you understand the process better.

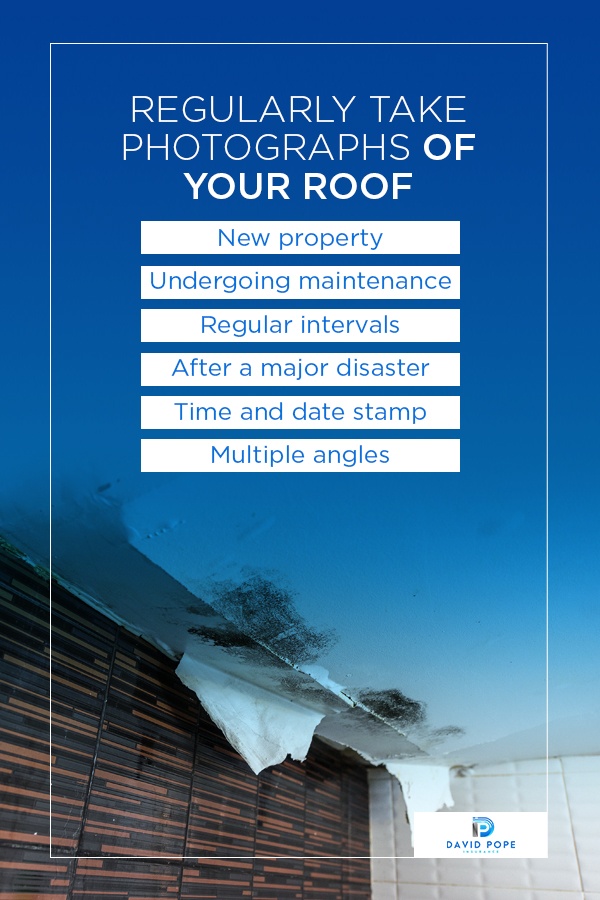

You may want to take photos of your roof regularly to show proof of what your roof looked like before and after the storm or disaster. The following are some instances in which you may want to take photographs or videos of your property’s roof:

Take pictures and videos to document your property’s condition. Remember to back up these videos and photos so you do not lose them. You may want to upload them to a cloud account or store them on a USB drive. The more evidence you can collect through documentation, the better.

It’s also worth noting that some contractors use roofing software to view your roof before and after the damage. This software lets them capture satellite images of your roof at different times to help speed up the repair time.

By fixing small problems, you may be able to prevent significant roof damage. Many roofing professionals suggest scheduling roof inspections twice a year. You may be able to increase the longevity of your roof by scheduling regular roofing inspections and maintenance. If you do not schedule inspections for your roof, you may actually void your warranty for roof damage.

Check Out Our Home Maintenance Guide

You can conduct your own inspections regularly to save money and get a better understanding of your property so you can make more informed decisions about maintenance in the future. However, this does not mean you should skip professional inspections. A professional inspection is critical, as roofing specialists can spot issues that the untrained eye might miss.

If your roof has sustained extensive damage and you want to file an insurance claim, you may need to provide proof of this damage to your insurance company. What information should you collect for this roof insurance claim? Among the information you may want to provide is documentation of the damage to your roof, written explanations of the needed repairs and the estimated costs of these repairs.

Documentation of damage can help you support your insurance claim. Taking before and after pictures of your roof and the exterior of your property may make the claims process easier and help you receive the settlement that you are entitled to for your loss.

Along with documenting the damages to your roof, you may want to document your roof repairs and maintenance. Your claims process may proceed more smoothly and stress-free if you can provide your insurance company with plenty of documentation.

Part of the information you may want to collect to support your roof claim is a written explanation of the needed roof repairs. If you can obtain a written explanation from an experienced roofing professional, this can help validate your insurance claim.

Finally, among the information you may want to collect for your insurance claim is the estimated costs of your roof repairs. When you file your claim with your insurance company, you may also want to provide the estimates of your roof repairs, along with the bills and invoices you receive.

This information can help your home insurance company determine what the payout should be for your claim. The more information you can provide, the more likely you may be to receive the amount of compensation necessary to cover your roof repairs or roof replacement.

Regarding homeowners insurance and roof damage, your policy likely covers damage to your roof as long as a covered peril causes the damage. However, there are a few instances in which your roof claim may be denied.

Why might your roof claim be denied? If your roof damage does not come from an act of nature or a sudden accident, then this may result in your claim being denied. For example, if the damage is caused by a lack of maintenance, your homeowners insurance policy may not cover those repairs.

So, what should you do if your roof claim is denied? First, remember that insurance adjusters can make mistakes — it happens. If your claim gets denied, request for a second adjuster to come and inspect your roof. Asking for a second opinion is a great way to get a different look at the roof. If the second adjuster approves your claim, you can proceed with repairs, though there’s always a chance they may deny the claim too.

If you still believe you have viable damage for a claim, you can push the issue further and ask an engineer to inspect the roof. If they find proof of storm damage, it can be submitted to your insurance company to help with the claim.

To help get your roof claim approved the first or second time around, you may consider asking your contractor to assist with the inspection. While the insurance adjuster ultimately has the last say regarding your claim, the contractor can help point out proof of damages.

Along with lack of maintenance, your homeowners insurance policy may not cover damages to an older roof. If your roof has surpassed its reasonable life span, then the costs of repairing or replacing your roof may be an expense you need to pay for out of your own pocket.

One of the most common insurance roof replacement questions is, “Will my premiums increase?” The short answer is that your home insurance rate will probably not increase as long as you were not found negligent.

Since damage caused by storms or natural disasters was not caused by your neglect, then your insurance company is unlikely to raise your premium after you file a roof claim. If the damage to your roof is determined to be a result of your own negligence, such as a lack of regular maintenance, then your premium may go up after you file a roof claim.

What is covered under insurance for roofs? Insurance policies can differ regarding repairing, restoring or replacing damaged roofs. Insurance policies typically cover acts of nature or sudden accidental events. However, other factors may impact whether your insurance policy covers damages to your roof, such as the age of your roof.

Coverage for damaged roofs often includes acts of nature or sudden accidental events. Examples of these acts of nature and sudden accidental events include:

Most plans will cover damages to your roof that are caused by these acts of nature or sudden accidental events. These incidents are out of your control and not caused by your own neglect, so your home insurance policy is likely to cover them.

On the other hand, general weather conditions, such as rain, wind or hail, may or may not be covered. Weather claims do rate with most companies. Most of the time, updating the roof age lowers the rate more than what the increase would be. Most companies give six months to file a claim after a storm, and you would have to link the damage to a storm in the last six months.

Always check your policy for details. Whether these weather events are covered depends on your policy’s parameters and the roof’s age. Your policy may also define whether the damage will be fully or partially covered.

Generally, the value of an asset can depreciate over time as the asset experiences the wear and tear that naturally comes from age and usage. This gradual deterioration and wear and tear of your roof may affect the claim you file with your insurance company.

After homeowners make claims on a new roof, insurance companies will likely cover these damages as long as they were caused by covered perils. On the other hand, older roofs are not likely to be fully covered. While the latest installation technologies and roof materials may offer longer lifespans for roofs, every roof will still eventually need to be replaced after it has surpassed its reasonable life expectancy. Generally, roofs that are more than 20 years old may be subject to limited coverage.

For older roofs, unseen issues may exist, such as the collection of moisture that can lead to water damage on your property. For properties with older roofs, many insurance companies may require roofing insurance inspections before they will write a new policy or renew an old one. If your roof does not pass inspection because of its age, the responsibility of repairing or replacing your roof will likely fall on your shoulders.

What is recoverable depreciation, and how does it relate to roof claims? Recoverable depreciation refers to your ability to make a claim for the depreciation of your property and the actual cash value. For example, if your roof depreciated by $2,000, you may be able to claim this additional amount.

Many insurance companies also include a statute of limitations for how long you can make a roof claim after a storm or disaster. As such, you may want to contact your insurance company as soon as possible after a major storm.

While it’s considered uncommon for insurance companies to pay for you to upgrade your roofing to be better than it was before the damage, there may be some materials that they’d provide discounts for. For example, many insurance companies offer discounts for impact-resistant or metal roofing. Ask your insurance company if they offer discounts on any roofing materials. If so, it may be worth upgrading.

Finding the right roofing contractor is an essential component in roof insurance claims. Whether you need a complete roof replacement or quick repairs, you will want to choose the right roofing contractor to work with.

To help with your insurance claim, you may want to choose an established, reputable contractor. Be wary of storm chasers. Often, these roofers will have the name “storm” in their business name and go door-to-door, stating that you have storm damage. Look for the following qualities to determine whether a contractor is suitable:

You may want to browse through a list of reputable professionals to help you find the right contractor.

A reputable contractor should also have proper insurance and licensing. Your contractor should have insurance to cover all of their subcontractors and employees, and they should be able to give you a copy of their certificate of insurance for verification. Without the proper insurance, you may be at risk for liability if a roofing employee is injured at your home.

Also, be aware that some states require roofing companies to be certified. If you live in a state that requires roofing contractor licenses, make sure you’re working with someone who has the necessary licenses. You may face several issues down the road if you choose to work with an unlicensed contractor.

You may want to research multiple contractors to choose the right contractor for your roof. Speak to a few contractors before you make your final decision. You should weigh the services and experience of a contractor when choosing among multiple contractors.

When doing your research, it’s best to avoid getting multiple estimates. There are a couple of reasons for this. First, it’s most common for your insurance company to set the price of your repair or replacement roof. In other words, the estimates become irrelevant once your insurance company approves your claim and determines how much they’ll pay you.

It’s also possible that your insurance company will want to see all the estimates you got and will only accept the cheapest one. Unfortunately, the cheapest option likely won’t be the best quality. This means you may get stuck with a low-quality replacement roof.

Ask every contractor you speak to for references so you can verify the quality of their work. We recommend asking for at least three references from each contractor you consider working with. If a contractor refuses to provide you with any references, you may want to consider other options.

You may want to seek customer reviews and ratings to help you make your decision. Customer reviews incentivize contractors to meet and exceed their customers’ expectations.

Before signing a contract, read it carefully and ensure that you thoroughly understand the terms of this agreement. Most contractors will be happy to explain the contract further if there is any part of the contract that you don’t understand.

At David Pope Insurance, we have more than 20 years of experience and we can find you the coverage you need to stay protected and safe. We know policy buyers can feel stressed and overwhelmed by the process of finding the right insurance policy and terms, which is why we strive to make the process as easy and stress-free for our clients as possible.

Request a Home Insurance Quote

Do you have more questions related to insurance and roof damage, such as wind damage roof insurance or supplemental roof claims? Contact us at David Pope Insurance to learn more about roof coverage today.