Life insurance policies are one of the best ways to ensure your family and loved ones are financially taken care of after you pass away. Picking loved ones to receive your death benefit might feel morbid, though it’s an essential step in creating your life insurance policy. Find out everything you need to know about life insurance beneficiary designation and life insurance beneficiary rules with this guide.

Jump To:

A life insurance beneficiary is the person or entity who will receive the life insurance benefit when the policy owner passes away. A beneficiary can be one or multiple people or even an organization. These individuals are entitled to life insurance proceeds through a contract you and the life insurance agency arrange. Upon your passing, your life insurance company will pay each beneficiary directly.

Choosing beneficiaries when you set up a life insurance policy guarantees your family members or other individuals and organizations are compensated and financially cared for after you pass away. After setting up your policy, you pay premiums to the insurance company, which will then be used to pay your designated beneficiaries when the time comes.

The purpose of a life insurance policy is to set aside money for your loved ones to have after you pass away. While it’s possible to surrender your policy for less than face value in cash, this is not the purpose of a policy, and you are not the intended receiver of the policy’s value.

Life insurance policies are long-term contacts, so a life insurance beneficiary will receive a death benefit from the insurance company after a policyholder passes away. They are legally designated to receive the death benefit as long as the policyholder was up to date on their premiums and met the policy prerequisites. Beneficiaries will usually receive a lump sum of cash, though it can be paid out in installments.

A will is a legal document that states how you would like your assets to be distributed among your heirs after your passing. Your will beneficiaries must wait to receive assets until after the probate process has been completed and debt obligations have been fulfilled, meaning their inheritance will be determined by what remains. A will does not supersede life insurance policies, so life insurance beneficiaries can claim a payout regardless of what the will states. Written will wishes will have no effect on life insurance beneficiaries.

Depending on your situation, you may choose to name multiple beneficiaries. There are a few ways to do this, and knowing your options is important to make the best decision regarding your policy. There are two types of beneficiaries — primary and contingent:

When naming multiple beneficiaries, you’ll choose one primary and as many contingent beneficiaries as desired. For example, say you have a spouse and a child. You might choose to name your spouse as the primary beneficiary and your child as the contingent beneficiary so they receive the benefits in case your spouse passes away before you.

You can also choose multiple primary beneficiaries who will split the benefits. There are two ways to name multiple equal primary beneficiaries:

Request a Free Life Insurance Quote

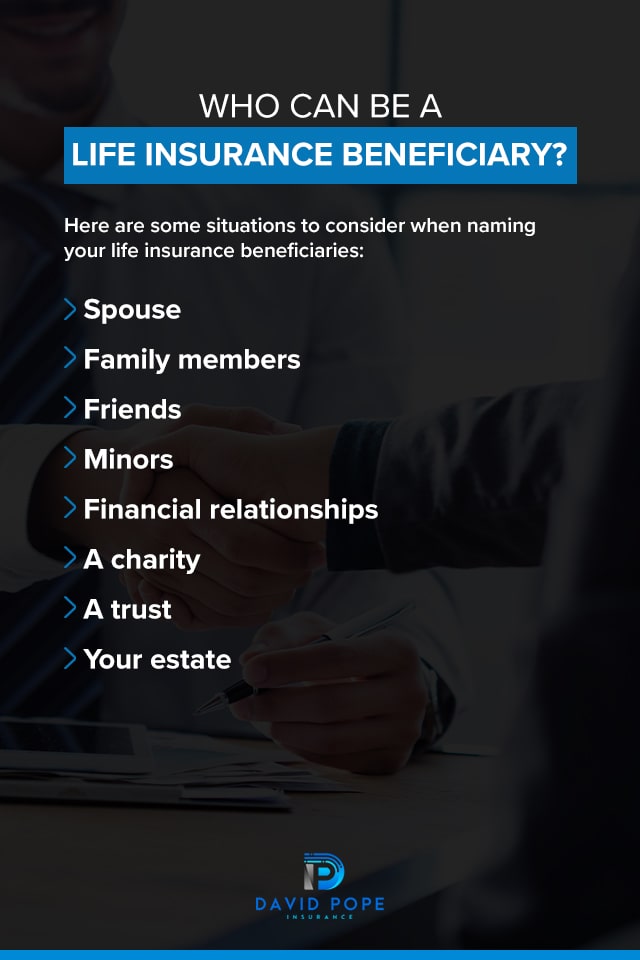

Technically speaking, anyone can be named a life insurance policy beneficiary. There are no hard-set rules specifying who you can name as a beneficiary, though there are possible restrictions if you’re married and living in certain states, as well as things to consider before choosing people as your beneficiaries. Here are some situations to consider when naming your life insurance beneficiaries:

Contact Us for More Information

When purchasing your life insurance policy, you’ll fill out a beneficiary designation form where you’ll specify who your beneficiaries will be. This legal document provides the insurance company with the necessary information to give the death benefits to each beneficiary when you pass away. Your life insurance should list the people you actually want to compensate after your death because it overrides anything stated in your will or other estate planning.

When designating your beneficiaries, you need to be as specific as possible when identifying each person. Being vague can cause confusion and disputes among your family and friends. For example, simply saying “spouse” in your policy can raise issues if you get divorced and remarried. For each person you list as a beneficiary, it’s best to include specific identifying information. Some information you need to make someone your beneficiary includes:

As much identifying information as possible is vital because names, phone numbers and addresses often change, and it’s important your insurance agency can contact the correct people after your passing. If you choose to designate a certain portion of the death benefit to each person, you’ll also want to specify that here. For example, you may want your spouse to get 50%, your son 25% and your daughter 25% instead of having them all split it evenly.

It’s also a good idea to notify people when you name them as beneficiaries. Notifying your beneficiaries can give them peace of mind and allows you to confirm their personal information.

You should consider giving each beneficiary a copy of your policy, as well as providing updated copies if you make any changes. With their own copy, your beneficiaries can take the initiative to contact your life insurance agency after your passing to stay updated with the process and ensure they get their portion of the proceeds without delay. This is also a good time to inform them of the percentage of benefits they’ll receive when the time comes.

When you designate a beneficiary, you’ll also need to specify whether each person is revocable or irrevocable. A revocable beneficiary can be removed from the policy without their permission, which is extremely helpful when your situation changes. Irrevocable beneficiaries can’t be removed or have their share changed unless you have their consent, which can be difficult if not impossible to obtain in some circumstances.

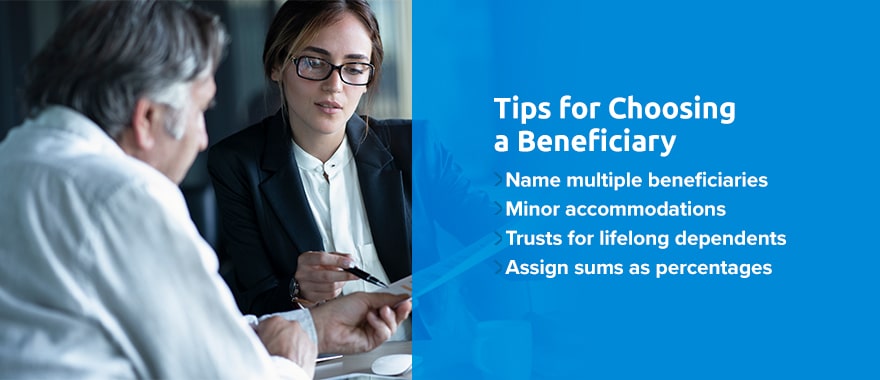

Depending on your situation and the number of people who are financially dependent on you, it may be challenging to choose a beneficiary. Because you can, for the most part, name anyone as a beneficiary, you need to take the time to consider carefully who you want to receive your death benefit. To help you think about all your options, here are some tips for naming a beneficiary:

Of course, if you’re really unsure about who to name as beneficiary, consider discussing it with close family or ask your life insurance provider for help.

Generally speaking, the policyholder is the only person capable of changing the beneficiaries of a life insurance policy. Those who are married and live in a common property state or who listed beneficiaries as irrevocable will need the beneficiaries’ permission to update the policy. While these beneficiaries can’t necessarily make changes themselves, they can limit you from doing so.

The only other exception to who can change your beneficiaries is if someone has power of attorney over you. If someone has power of attorney, they’re legally allowed to make medical, financial and legal decisions on your behalf if you’re unable to do so. For example, if you’re deemed mentally unfit to make these decisions, your power of attorney can act on your behalf and edit your beneficiaries.

Otherwise, you can make changes to your policy’s beneficiaries quite easily. As long as your beneficiaries are revocable, you can change them at any time through your life insurance company. This makes it easy to keep your beneficiaries updated as often as possible to ensure they’re who you want.

If you don’t name a beneficiary for your life insurance policy, the death benefit is most often paid to your estate. Without a listed beneficiary, the benefits from your policy will be delayed because it will be unclear who they’re supposed to go to. This results in a lengthy legal process called probate. When your life insurance goes to probate, a court must assess your financial situation to determine the best way to distribute the assets from your policy.

While the court works to divide your estate, your family and loved ones may have to wait months to receive any of the proceeds from your estate. This means they might not receive the money when they need it most, or they may receive less than what you would’ve wanted. If you want to prevent creating a lengthy legal process for your loved ones, it’s best to name beneficiaries and keep them updated as much as possible.

While it’s ideal for loved ones to tell you if you’re a beneficiary of their life insurance policy, it doesn’t always happen this way. Your loved one might forget to tell you the details of their policy and how to claim the death benefit. If you’re the beneficiary of a loved one’s life insurance policy, the insurance company may contact you, though they may not be aware of the policyholder’s death. It’s common for insurance companies to learn of the policyholder’s death through loved ones looking to make a claim.

It’s best not to rely on the insurance company to find you first. If you think you may be a beneficiary of your loved one’s life insurance policy, there are ways you can find out and take action. First, try looking through the deceased’s papers and electronic files, as they may have copies of the policy or contact information for the insurance company. Also try asking family members about a policy, if possible.

Because so many life insurance policies go unclaimed, some insurance companies opt to make policies easier to find through databases. For example, the National Association of Insurance Commissioners (NAIC) offers a free database for locating life insurance policies. When you request a search, NAIC asks all participating companies to search their records for your loved one’s policy so they can contact you if applicable. If you think you’re a beneficiary, do everything you can to ensure you get the benefits left for you.

Whether you are creating your own life insurance policy or are a beneficiary on a loved one’s policy, you will want to know how the process of death benefit payouts works. Most payouts follow a few simple rules:

In general, the Internal Revenue Service (IRS) doesn’t consider life insurance proceeds as gross income, which means beneficiaries typically won’t have to pay income taxes on it. However, a couple of exceptions may require beneficiaries to pay taxes, including:

These taxable situations are important to keep in mind while planning the details of your life insurance policy. If you want your beneficiaries to receive the maximum benefits, consider making choices that are least likely to result in taxable payouts.

You can name charities and trusts as primary or contingent beneficiaries. Similar to irrevocable and revocable beneficiaries, you can use irrevocable and revocable trusts to protect your assets. Trusts allow you to make specifications about how the money from your death benefit is used.

For example, you can create a trust to be used explicitly for the care of your minor children should you pass away while they’re still minors. If your trust is revocable, you can edit it throughout your life to reflect your situation. If it’s irrevocable, you cannot change the terms.

If you’re a charitable person and hold a specific organization near and dear to your heart, you can name it as a beneficiary of your life insurance policy. Naming a charity as a beneficiary is a noble way to create a legacy for yourself after you’ve passed.

While preparing for your passing is never high on our lists of fun things to do, it is necessary to ensure our loved ones are taken care of in our absence. At David Pope Insurance, we can help you find comprehensive life insurance coverage within an affordable budget. Our flexible agents will work with you to generate policies and quotes to meet your financial situation. We’re local to Missouri, so you’ll appreciate our personal service when you contact us for a free life insurance quote.

Request a Free Life Insurance QuoteContact Us for More Information