Many parents wonder how to reduce insurance costs when their child is in college. It’s often confusing to tell whether you need coverage for a child living away from home, especially for out-of-state students. Removing your child from your insurance policy is a significant decision, and the variety of insurance types makes the choice more complicated.

David Pope Insurance Services, LLC covers auto insurance, renters insurance, life insurance and health insurance for college students. We can keep your child protected as they transition into this new stage of life.

Read on to learn more about insurance for college students and how David Pope Insurance can help.

Auto insurance is essential for safe driving. If your child moves away from home for college, you have to decide whether to keep or remove them from your insurance policy. Young adults tend to be higher-risk drivers, which can make car insurance costs more expensive for parents. Many parents want to reduce their auto insurance premiums after their child leaves for college.

You may want to keep your child on your policy if they commute to a college or drive regularly for their studies. That way, they still have solid coverage while navigating traffic each day. Or, you might prefer to remove them from your policy if they live on campus and don’t have access to a car.

Here is a closer look at each option:

If your child commutes or drives often while at college, you may want to keep them on your insurance policy. Even if your child doesn’t plan on driving while attending college, you could keep them active on your policy. Leaving them active gives them coverage in situations like:

Other benefits of keeping your college-aged child on your policy include:

The major downside of keeping your child on your policy is the higher premium for including a driver under 25. But this increased premium could still be lower than possible accident costs without insurance coverage.

Follow these steps if you plan on keeping your child on your insurance policy:

If your child doesn’t have or need regular access to a car, you may consider removing them from your insurance policy.

However, your removal options may have limits, even for temporary periods. The process depends on what your insurance carrier allows. If your insurance provider lets you exclude your college student from your policy, follow these steps:

You probably want your child off your insurance account if they get a separate policy. Typically, your child should obtain their own policy if they live apart from you permanently, especially if their vehicle is titled to them. They can get a lower rate at their new zip code.

The major drawback of taking your child off your insurance policy is they become uninsured. This lack of coverage might negatively impact your finances if your child gets into vehicle-related accidents. Unless they acquire their own policy, your college student remains at risk without coverage.

For many parents, leaving their college-age child on their auto insurance policy is the better option. Depending on your insurance provider, it may even be your only option. If you’re still unsure which is the best option for you, talk to your insurance agent.

Renters insurance protects your personal items while you rent a unit from someone else. Most college students live in rented properties during their studies, making this insurance type essential.

Whether a college student needs renters insurance depends on their residence location and policy protections.

If your college student lives at home while attending college, your homeowners or renters insurance probably covers them. If they live on campus in a dorm or other school-owned property, your homeowners or renters insurance should extend to them if they’re a dependent on your policy.

Living on campus comes with the convenience of being close to classes and friends, but it might be confusing to determine if your child needs coverage with renters insurance. Your insurance policy may cover your child, and the university often assumes liability for its property. However, it does not protect a student’s personal property.

Sometimes, homeowners insurance won’t provide enough coverage to cover all your student’s belongings, especially if they have expensive electronics or musical instruments. College students in dorms can get student insurance or dorm insurance to cover their property. Parents can also extend their homeowners policy with scheduled personal property insurance to cover additional items.

For off-campus housing, homeowners and renters insurance typically put a cap on coverage. Renters or homeowners insurance may not cover a loss in off-campus housing. To secure coverage for events like theft, your child would need to obtain a policy in their name for liability and loss coverage.

Here are some reasons college students should get renters insurance for their off-campus apartments:

If your child can purchase renters insurance with their roommate or roommates, it may be more affordable. This strategy can save each student money, though their roommates’ claims also go on their claims history record. At renewal, this record could cause your child to pay more. A roommate could also move out or stop paying their portion of the premium.

Whether your student rents a house, lives in a dorm or leases an off-campus apartment, they may have valuable possessions they want to protect. These days, many students take expensive gaming consoles, laptops, sporting equipment, furniture and wardrobes with them to college. If any of these costly items are stolen or damaged, you could face significant replacement bills.

Despite what many renters believe, property owners don’t have to reimburse you after a catastrophe. These disasters can include storms, theft or fire. Even if your landlord is sympathetic, their insurance doesn’t cover their tenants, and they aren’t under any obligation to reimburse you.

If you’re renting a living space, you are responsible for protecting your possessions. Basic renters insurance policies are affordable and worth the extra costs. Renters insurance provides you with the following protections:

Renters insurance gives coverage for college student situations like:

If you decide to purchase renters insurance, you should research whether the policies offer replacement cost or cash value for your claims. Your selection impacts how much renters insurance costs.

A policy that offers replacement value gives you the full value of your personal belongings. In contrast, a policy with cash value only provides the worth of your belongings at the time you make the claim. Cash value includes the original value minus any depreciation.

Despite its higher cost, you may want to secure replacement coverage if you have substantial claims.

With so many options to choose from, finding the best renters insurance policy can feel overwhelming. These are a few tips for selecting one:

Remember that renters insurance does not cover cars, even ones parked at the apartment or on campus property. If someone or something damages your child’s vehicle, you’d have to make a claim through your auto insurance policy instead.

Another factor to consider is that students living on campus may be subject to the university’s code of conduct. If an incident damages property, the university could pursue disciplinary action against your student. Underaged drinking on college campuses can also result in university and legal action.

College students already have a lot on their plates. Keeping track of their class schedule, maintaining a good GPA, finding internships, joining clubs and graduating on time are all enough to make one person’s head spin. Life insurance isn’t on the minds of most college students. But parents might consider whether life insurance plans are necessary for their college-aged kids.

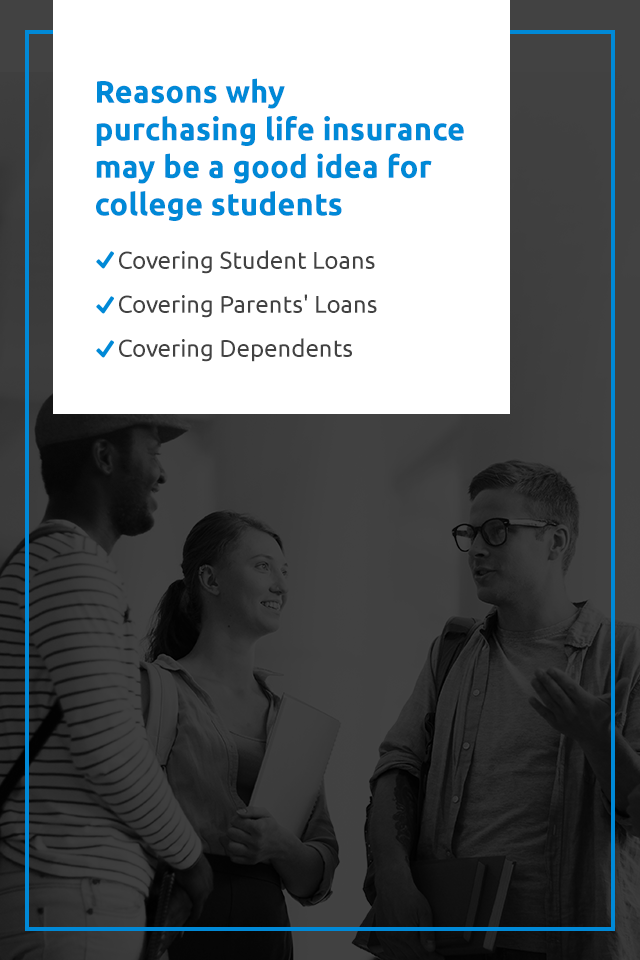

Here are a few reasons why purchasing life insurance may be a good idea for college students:

Student loans are a common reality for many college students today. If students take out federal loans and die before they can pay off their debt, the government will discharge the loan amount.

Private student loans are a different story. These student loans are more similar to traditional loans in that the borrower must pay them off regardless. Cosigners are common for private student loans, and these adults become responsible for paying off debt if the student passes away.

After a student with private loans dies, the lender may accelerate their repayment schedule, asking them to immediately pay their loans in full. This phenomenon is “automatic default,” and it could spell serious financial trouble for the cosigner of these loans, which tends to be the student’s parent. If you find yourself in this situation, you may struggle to pay the loan as quickly as required, resulting in damage to your finances and your credit score.

Your family could also face a financial burden if you have a federal Parent PLUS loan. The lender discharges these loans after you or your child dies. They are still taxable income, which could leave your family scrambling to cover a large tax bill.

However, a life insurance policy covers private loan costs if a student dies, providing the cosigner financial protection. A small policy should also cover the tax bill that comes from a Parent PLUS loan.

As the parent of a college student, you might offer to pay for their college education. You might finance your child’s college education through a 401(k) loan or home equity credit.

You need to pay these debts even if your child passes away, and this can add a significant financial burden on a family during a time when you’re already dealing with immense emotional turmoil.

One option to ease financial burdens is taking out a term life insurance policy for the total amount of expected debt. This policy can help cover those costs.

If a college student is married or has children, they should obtain life insurance. This coverage offers protection to a student’s spouse and kids by paying the student loans, funeral expenses and other debts if the student dies. The student’s children may also receive financial support from this life insurance policy, depending on the policy terms.

Deciding which life insurance type to purchase can often become confusing. Because term life insurance covers the insured for a set period and is more affordable than whole life insurance, it tends to be the best option for most college students.

The right policy for you should:

If you don’t know the term length and interest rates for the loans, uncover that information so you can secure an adequate amount of coverage.

Health insurance is another crucial consideration for college students and their parents. Fortunately, you can choose from many options:

Obtaining basic insurance coverage can be simple and affordable if your child’s college offers a health plan for students. In most cases, a student health plan is qualifying health coverage, so your child won’t have to pay any penalties for being uninsured.

If a student health plan isn’t the right choice for your child or is unavailable, you may also want to consider a Health Insurance Marketplace plan.

If your child is still a dependent and lives in the same state as you, you can include your child on your application during Open Enrollment. You can also add your child during Special Enrollment Periods. Your child can qualify for these periods in special circumstances, such as losing their student health plan.

If your child is still a dependent but resides in a different state, they can either stay on your plan or apply for a plan in their college’s state.

If your child remains with your policy, perform thorough research. Explain the provider network with your child so they understand how the plan works in a different state.

Your child can also opt to apply for coverage in their college’s state, especially if they find a plan that meets their needs better. Here’s what to do if your child secures insurance coverage independently:

If your dependent is 26 or older, they may need to obtain a separate plan.

At David Pope Insurance Services, LLC, we provide the right affordable insurance policies to our clients in Missouri. We strive for flexibility to provide clients with the coverage they need. We can provide auto insurance for teen drivers and older drivers, home insurance for first-time buyers and buyers of high-value homes and life insurance for clients of all ages. No matter your needs, we find the best insurance solution.

Request a free insurance quote from us today!