While riding a motorcycle is fun and exhilarating, it can also be risky. This is why many states require that motorcycle drivers carry motorcycle insurance. This insurance protects you financially if you are in an accident while riding your bike and you, your passenger or another driver is injured or your property is damaged.

The costs of repairs and medical bills can be significant after an accident, so motorcycle insurance prevents you from having to pay these costs out of pocket. We have developed this guide to motorcycle insurance so you know what to expect from this insurance and can navigate your coverage options.

In most states, if you are an owner and driver of a motor vehicle, you need to maintain motor vehicle insurance coverage. To ensure motorists in Missouri maintain this coverage, for example, the state mandates that motorists show proof of insurance when renewing license plates and registering vehicles.

For motorcycle insurance, Missouri is an at-fault state. If you are at fault for a car accident and you don’t have the right coverage, you may face penalties, fines, license suspension and even jail time. Below, we take a look at the motorcycle and motorcycle insurance requirements in Missouri.

Each state must clearly define a motorcycle for insurance and law enforcement purposes. In Missouri, a motorcycle is defined as follows:

Missouri is a great state for motorcyclists who want to ride in a breathtaking rural setting. To do so, you need to ensure your motorcycle is always street legal. In Missouri, you and your motorcycle must include the following equipment:

You are not required to wear eye protection, and your motorcycle is not required to have mirrors, turn signals, passenger footrests or a passenger seat.

In many states, you need to have motorcycle insurance that meets minimum limits for bodily injury and property damage or destruction. The state of Missouri, for example, has higher requirements for coverage than some states, but this coverage protects you if you are in an accident that results in property damage or a serious injury. In Missouri, you need to have at least:

If your motorcycle insurance policy does not cover all costs, you may have to pay for these additional costs from your own pocket.

Compared to car insurance policies, motorcycle insurance policies that are liability-only tend to be inexpensive. However, you may want to purchase additional coverage to ensure you have adequate financial protection in the event of an accident. Below are some common motorcycle insurance options:

When you have full-coverage motorcycle insurance, this usually means you have a policy that includes liability insurance, collision insurance and comprehensive insurance for your motorcycle. Collision and comprehensive insurance differ from property liability insurance, as they cover your own damages if your bike is damaged or you are in an accident.

If you are involved in an accident while riding your motorcycle, collision insurance covers the cost to replace or repair your motorcycle, minus your deductible. This is the amount you agree to pay for a claim out of pocket. Your policy may cover up to your motorcycle’s Kelley Blue Book value.

Comprehensive motorcycle insurance covers the costs for replacing or repairing your motorcycle for almost any event other than a collision. If your bike is stolen, vandalized or damaged in a storm or fire, the repair or replacement costs may fall under comprehensive coverage.

This coverage applies even when you are not riding your motorcycle, which means you may want to maintain your comprehensive coverage when your motorcycle is in storage. If your motorcycle would be costly to repair or is relatively new, comprehensive and collision coverage are generally worth the cost.

Keep in mind that comprehensive and collision coverages tend to pay only for the cost of standard or factory parts. Additional parts, graphics, features, paint jobs or equipment may not be covered by your insurance provider unless you already have specific coverage for it.

Total loss coverage is similar to gap coverage, and you may want to purchase it so your motorcycle is covered if it’s totaled in a crash. Your insurance provider will pay your motorcycle’s suggested retail value for replacement, minus your deductible. This may mean there’s a significant difference between the amount the insurer will pay out and the bike’s book value, as the value of a motorcycle may significantly decrease the moment you drive it off the lot.

You may only be able to obtain total loss coverage in the first few years of a motorcycle’s life, as an insurance company may not replace a bike that is worth much less as it ages. However, if you recently bought a new motorcycle, this coverage can be particularly valuable.

This coverage is sometimes referred to as UM/UIM coverage, and you may want to add it to your motorcycle insurance policy. If you are injured and your bike is damaged in an accident caused by a driver who is not adequately insured, this coverage protects you. If the costs for damages exceed the other driver’s policy limits or they don’t have any liability insurance at all, uninsured/underinsured coverage picks up where the other driver’s coverage leaves off.

UM/UIM motorcycle insurance covers bodily injury, along with lost wages, medical bills and other costs you may incur if the other driver isn’t adequately insured. Ask your insurance provider whether uninsured/underinsured coverage includes personal property damage. If not, you may also have to purchase UM/UIM property damage coverage.

This coverage is not available in every state, but where it is, medical payments coverage can cover the expense of medical bills for you if you are injured while on your motorcycle. This covers you no matter who is responsible for the accident — whether you are hit by another driver or you crash into a bush, your medical bills are covered up to your policy’s limit.

This coverage is optional, and you can choose from different claim limits. Medical payments coverage does not cover lost wages or other costs. If you do not have health insurance or do not have a sufficient amount of health insurance, you may want to consider purchasing medical payments coverage, as driving a motorcycle comes with risks, regardless of how carefully you drive.

In some states, you may have the option to buy personal injury protection, or PIP insurance. This is similar to medical payments coverage, except it covers a broader range of costs that result from an injury, such as:

With PIP, you may have coverage for medical bills for injuries that you or your passenger sustain as a result of an accident, no matter who is at fault. While some insurance companies offer PIP, some states do not allow insurers to sell this coverage to motorcyclists because of motorcyclists’ higher accident rate.

If you plan to take long trips on your motorcycle, you may want to purchase trip interruption coverage. Trip interruption coverage pays out for transportation, food and lodging if your motorcycle is unusable as a result of a crash far from home.

The distance from home is usually defined in your policy as a certain number of miles. You may also need to provide proof that you have paid for meals and lodging to be compensated through your trip interruption coverage. This means you may want to keep your receipts or bank statements so you can claim compensation.

You may want to consider adding trailer coverage, which covers damage and loss of motorcycle trailers up to a certain amount after a rollover, collision or natural loss like an earthquake or storm. The amount covered by this insurance varies depending on your insurance company and your policy.

Insurance for roadside assistance is optional for a motorcycle insurance policy. With roadside assistance, you may have coverage when you need your motorcycle to be towed to a nearby shop. This insurance may also cover a flat tire, battery failure and electrical or mechanical breakdown, including free delivery of fuel, oil or water.

If you are considering this coverage, make sure you don’t have these benefits already through other means, like a AAA membership.

The average cost of motorcycle insurance may seem expensive compared to auto insurance. This is because when a motorcyclist is in an accident, there is a higher risk of death or injury. This higher risk is due to several factors:

Your age, gender, location, driving record, security measures, type of coverage, make and model of your motorcycle, and who else you insure to ride it are all factors that influence your motorcycle insurance premium. For example, if you are a younger driver, you may pay a higher premium.

Fortunately, you can take steps to lower your motorcycle insurance premium, such as:

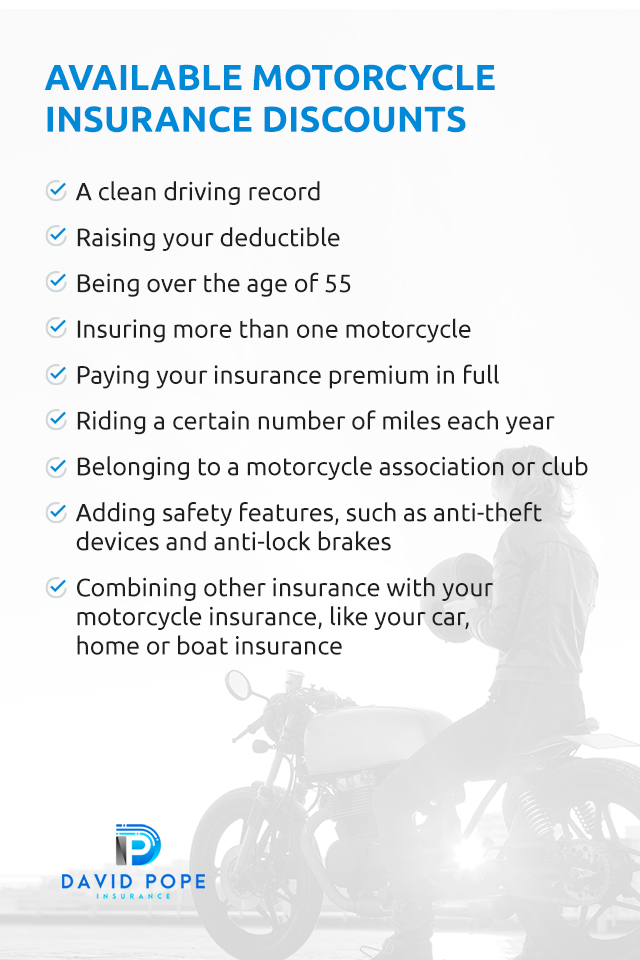

Speak with your insurance agent about the types of motorcycle insurance discounts available to you. Some insurance companies offer discounts for:

If you are eligible for any of these discounts, you may be able to lower your motorcycle insurance cost.

Below we cover some of the frequently asked questions about insurance for motorcycle owners:

Whether your motorcycle insurance covers track days depends on your insurer and your policy. If your insurer does cover track days, there may be some exclusions. Many insurers won’t cover accidents that occur during a timed event, speed test or race, for example. An insurer may pay out for an accident that occurs on a track day while you were riding to become a more defensive, safe driver and to improve your bike-handling skills.

Since coverage can vary, ask your insurance agent what your policy covers before your bike is damaged and in need of repairs.

Whether other riders are covered depends on your insurer and your policy. For example, if you purchased solely minimum liability coverage, your policy may not cover other riders. Whether coverage applies depends on whether you loaned your motorcycle to someone else to drive or whether the rider was a passenger while you were operating the bike.

To receive a definitive answer, speak with your insurance agent and review your insurance policy. When you inquire about rates and policy information, be sure to ask about whether other riders are covered under your motorcycle insurance.

Full coverage refers to a motorcycle insurance policy that includes every important element of insurance, which is liability, collision and comprehensive coverage. If your motorcycle is newer or your motorcycle is a model that may require costly repairs if damaged, you may want to ensure you have full coverage. If you are unsure whether you need full coverage, an insurance agent can provide a recommendation based on your situation.

Ask your insurance agent what kinds of coverage you would have with full coverage. You especially want to know the maximum amount of coverage you can expect per accident. When you are purchasing your policy or renewing it, review each coverage with your agent and ensure you know what you’re getting.

Your auto insurance does not automatically cover your motorcycle. Unless you can add your motorcycle to your policy, you may want to purchase motorcycle insurance. Going without this coverage can have devastating consequences if you are in an accident while riding your bike.

Even if you only ride your bike on the weekends, you still need motorcycle insurance. You may need to purchase the state minimum insurance, as you would with your car. If you do not have insurance, you may be forfeiting your claim and limiting what you can recover. If you are left with a permanent disability, this can make a terrible accident all the more devastating. Motorcycle insurance is relatively inexpensive compared to the thousands of dollars you may spend if you forgo it.

If you are concerned about theft, motorcycle insurance may offer coverage for this loss. Most comprehensive insurance policies cover motorcycle theft, regardless of whether it occurs at home, during transport or on the road. Comprehensive coverage also applies to anything that may be stolen from your motorcycle, such as:

Keep in mind that an insurer will pay out only for a loss that exceeds your deductible. With a lower deductible, you’ll pay more for your premium, but you can choose your deductible amount when you buy your policy. You may want to keep records of any modifications or add-ons you made to your motorcycle that impacted its value.

The costs of owning and operating a motorcycle go beyond the purchase of the bike itself and insurance. You may want to buy equipment that can keep you safer on the road. Many policies offer extensive financial protection and support for damage to your motorcycle up to your policy coverage limit or your bike’s value. You may also have insurance for your accessories, such as:

For example, your custom leather chaps may be covered in an accident, as long as they’re damaged due to a covered claim.

David Pope Insurance is a family-owned insurance broker in Union, Missouri. We serve residents seeking motorcycle insurance coverage in the locations of Missouri, Kansas, Arkansas, Tennessee, Nebraska, Illinois, Iowa and Colorado. We can cover all your insurance needs, including:

At David Pope Insurance, we understand everyone has different insurance needs, and we strive to find you a great policy at the best premium possible. With us, you won’t have to wait for days to receive a quote. Instead, we’ll get your quote to you in a matter of hours.

Our aim is to be flexible in the policies we obtain for our clients, and this flexibility has led to us becoming one of the most respected insurance brokers in Missouri. Contact us today to learn more about motorcycle insurance in Missouri, or fill out information to request a precise quote for your situation.