While trees can be a beautiful addition to your yard, they can also present a danger to your home. All it takes is one severe storm to upend a tree on your property. If a tree comes down on your home, will your homeowners insurance protect you financially? Will your policy cover the costs for the removal of branches and debris?

Homeowners insurance may cover some forms of fallen tree damage, but your policy may not cover everything. As such, we are answering a few frequently asked questions about tree damage and home insurance so you know what to expect from your policy if a tree damages your property.

Jump To:

Whether your homeowners insurance covers fallen trees will depend on several factors, including the types of damage your property sustained and the cause of the incident. Whether car insurance covers tree damage depends on your coverage type. Comprehensive will likely help repair costs from fallen trees, but liability only won’t.

Trees can add value to your property but can also be expensive to replace. Typical home insurance covers damage to trees and shrubs that results from accidents or disasters, such as:

What about damage to your property caused by fallen trees? Will this be covered? The simple answer to this question is that it depends. Typically, your home insurance will protect your home and other structures on your property, like a shed or fence, after specific causes. When a tree falls due to wind, hail or lightning, your policy will usually cover the resulting damage.

The cause of tree damage is a key factor in determining whether your repairs will be covered. If a tree is otherwise healthy but damages your home due to strong winds, your home insurance will likely help pay for repairs to the damages your house or other structures sustain.

If the damage is related to a lack of maintenance or is caused by negligence, your home insurance will likely not cover the loss. For example, if your tree was already rotting and at risk of falling before the storm, you will probably need to pay for the damage out of pocket.

An easy way to determine whether your homeowners insurance will cover tree damage is by considering whether the damage was accidental and sudden or gradual. Accidental and sudden damage will likely be covered, while gradual damage is not likely to be covered.

A common example of sudden, accidental tree damage is a windstorm that uproots a tree and sends it crashing down on your house or property structures, such as your garage or shed. A common example of gradual damage is tree root damage. Home insurance likely will not cover damages that result from tree roots impacting your plumbing or growing into a part of your home. Since roots grow over time, this is considered gradual damage.

An exception is when the gradual damage causes a secondary issue, such as a burst pipe that floods your home. You may receive coverage for the water damage under your home insurance policy.

Tree removal is typically not covered if a tree comes down but does not cause any structural damage. Unless your home needs repairs as a result of the fallen tree, you will probably need to cover the tree debris removal yourself.

There are exceptions to this, however. For example, if the tree is an obstacle in your driveway that prevents you from driving, your insurance provider may cover the removal costs. Like many coverage specifics, the answer can vary depending on your insurance carrier and policy.

Here is a simple breakdown of when home insurance may not cover tree removal:

If you want tree damage from a flood or earthquake to be covered, you can obtain separate earthquake insurance and flood insurance policies, as home insurance typically does not cover these perils.

If you have homeowners insurance, you may have coverage for removing tree debris if a tree or branch crashes into an insured structure on your property. Typically, the removal of tree debris will also be covered if it blocks your driveway or blocks an accessible entrance.

If the tree did not cause damage to an insured structure on your property, block your driveway or block an accessible entrance, your home insurance policy likely will not cover the removal of debris from trees. Debris that simply ends up on your property is not likely to be covered.

Home insurance policies also place coverage limits on debris removal, so review your policy to determine your coverage cap. If you think it necessary, you may also want to purchase an endorsement, which is an additional level of coverage that extends to removing tree debris from your property.

Review your covered structures as well. Your policy may cover:

Covered structures can vary by policy, so check with your insurance agent if you are uncertain which of the structures on your property are covered.

If you have home insurance, your policy will likely cover most or all of the tree removal cost. Depending on your policy type and your insurance provider, the covered cost is typically between $500 and $1,000, though some insurance providers may offer higher coverage limits.

If personal belongings in your home were damaged, you may also be reimbursed for new items, along with the repairs to your home. This coverage will come from the personal property and dwelling coverages in your policy, so review your limits to determine how much coverage you could potentially receive.

Your home insurance policy may include additional protection up to a certain percentage for trees and shrubs. This allows you to replace damaged or destroyed landscaping in the event of a covered peril. For example, if you have a dwelling coverage limit of $200,000 and your policy will cover 5% of your dwelling coverage for your damaged landscaping, your insurance company will cover up to $10,000 for these losses.

However, if the tree did not strike an insured structure, you will likely not have coverage for the debris removal unless the tree blocks your driveway or a ramp that assists residents who use wheelchairs.

The rule of thumb is that the insurance policy that covers the damaged property will pay for the loss. So if a covered peril like a windstorm knocks a healthy tree from your property onto your neighbor’s home, your neighbor will likely need to file a claim with their insurance provider.

Typically, you will only be responsible for a tree falling on your neighbor’s home if your negligence is determined to be a contributing factor. For example, if the tree was dead and rotting, you may be considered responsible. If your tree falls on your neighbor’s property, your neighbor’s insurance company may also attempt to recoup their losses from your insurance provider.

Request a Free Homeowners Insurance Quote

The short answer is that you are likely to be covered regardless of who owns the tree. You are covered against perils that are listed on your policy in the personal property provision, such as:

Similar to a situation in which a tree on your own property falls, the tree must damage an insured structure or block your driveway.

If your neighbor’s tree fell on your property due to rot, age or disease, your insurance provider will probably cover your claim. In this situation, insurance companies typically opt to avoid the legal fees involved with pursuing legal action against your neighbor, so it is unlikely they will attempt to collect compensation from your neighbor’s insurance carrier.

Windstorms and hurricanes can cause trees and branches to become projectiles capable of causing significant damage to your property and traveling far distances. It’s important to file a claim with your insurance provider if a tree falls on your home or another structure on your property, no matter where the tree originated from.

If your claim is denied, you may want to speak with your neighbor to determine whether they would be willing to pay for the tree removal or split the cost.

If a tree falls on your vehicle, the cost for removal may be covered under your home insurance policy if the tree fell due to fire, explosion, aircraft, lightning, riot, theft, vandalism or a vehicle owned by someone else. Your home insurance will also usually cover the damage if the tree fell through your garage and struck your vehicle.

If a storm caused the tree to fall or your vehicle was damaged outside your garage, your home insurance will likely not cover tree removal. Instead, you could file a claim with your car insurance provider if you have comprehensive coverage. Comprehensive coverage usually helps cover repairs for damages to your vehicle caused by a falling object.

You can reduce the potential damage of a fallen tree by ensuring your trees are properly maintained and prepared for storms or winter weather. Prune or remove branches from your tree if they appear dead, for example.

If the tree seems to be dead or you suspect a pest or termite problem, hire an arborist to perform an inspection. An arborist can determine your tree’s health and identify whether any branches or the tree itself needs to be removed. You can ask them for a reference to a reputable tree removal or trimming service. If you suspect your neighbor’s tree may be rotted or hazardous, discuss with your neighbor the possibility of having it removed.

You can also reduce your out-of-pocket costs by obtaining the necessary tree damage insurance coverage.

Ultimately, the amount of coverage you have for tree damage will depend on your homeowners insurance and what caused the tree to fall. Standard homeowners insurance policies will cover the damage to your insured structures and their contents if the tree drops because of an accident or natural disaster.

Your coverage limits will determine the maximum amount your insurance provider will pay for tree damage, so you may want to consider increasing your coverage limit or obtaining separate coverage to ensure you are adequately protected.

For example, you may want to consider your dwelling coverage limit and your coverage for other structures. Dwelling coverage applies to damages to the structure of your house in the event of a covered peril. If you have a dwelling coverage limit of $200,000, your home insurance policy may cover up to $200,000 to rebuild or repair your home. Remember that you may still need to pay your deductible, and this deductible amount is selected at the time you purchased your coverage.

You can learn more about your coverage limits and coverage types by reaching out to your insurance agent.

Severe storms can bring heavy rain, high winds and lightning, all of which can result in trees falling. As with any potential incident that could occur, it’s best to know beforehand what you should do if a tree falls on your property.

Follow these steps if a tree falls on your property to protect your home and your family:

Your first step is to check on everyone in your home quickly to ensure they are safe and know how to exit the home. If you do not currently have an evacuation plan, develop one and practice it with your family so everyone knows what to do in the event of a storm. You may want to include a bag with emergency supplies, such as your car keys, cash and copies of important documents. This emergency bag can ensure you have everything you need until the danger passes.

Your next step is to call 911. Inform emergency services about what happened, and they will instruct you on what to do next. A fire crew or a public utility representative may be sent to your home to ensure it is safe by checking power lines and making sure there are no electrical problems or danger of fire.

Even if you believe a fallen tree or branch is small, avoid trying to deal with the issue yourself. Wait for a professional to work on your roof, as roofs can be dangerous and slippery, especially during or after a storm. A fallen tree can also compromise the structural integrity of your roof.

As soon as it is safe to do so, take pictures of the damage caused by the tree. Do your best to capture several angles, including distance and close-up shots. Be cautious while taking photos so you are not injured in the process. You can show these photos to your insurance company as evidence of the tree damage.

Reach out to your home insurance provider so they can cover the damage and the cost of the tree removal. As long as a healthy tree damaged an insured structure on your property, your home insurance provider is likely to cover all or part of the cost.

When you report the tree damage, your homeowners insurance provider will let you know how you should proceed. Your insurer may also send an expert roofer or recommend one to cover exposed areas of your home and prevent further damage. It’s best to hold off on permanent repairs until your insurance agency agrees on your claim amount. This ensures you know how much they’ll cover and whether you’ll have to pay for anything out of pocket before making any repair decisions.

Your next step is to find a reputable roofing contractor who can handle the repair work on your house or insured property. Rely on experts to handle this process, as tackling the repairs yourself can be dangerous.

When considering contractors to handle your repairs, be sure to choose someone who has experience with the repairs you need. For example, if your garage door needs to be replaced, hire someone who specializes in garage door replacements. This ensures your repairs are done properly and decreases the chance of complications or surprises during the repair.

You should also look at a contractor’s reviews and testimonies. See what kind of experiences others had with the contractor. The higher the ratings, the more likely you’ll have a good experience and receive a quality repair.

Just keep in mind that you shouldn’t make any final payments to your contractor until the work is completed and you’re satisfied with it. The last thing you want after dealing with tree damage is to be stuck with an insufficient repair.

Finally, if a tree has significantly damaged your home, you may not have the option to continue living there until the repairs are completed. Before you leave the home, lock the windows and doors. You may also want to secure anything of value in your home or take it with you. Depending on the extent of the damage, you may want to put tarps up to prevent more debris or rain from getting into your home.

For example, if the tree left a hole in your roof or broke windows, covering the hole with a tarp and boarding up the windows will prevent the interior of your home from sustaining more damage until it’s permanently repaired.

One of the best things you can do when dealing with tree damage, or any other form of property damage, is to track any expenses you incur when dealing with the damage. For example, if you pay to have your windows boarded or roof tarped, keep receipts in case your insurance company will reimburse you for these expenses. Insurance companies may also reimburse you for all or part of the cost of a hotel or rent at a new place until your repairs are complete.

Tracking these expenses ensures you’ll get a fair reimbursement if that’s an option.

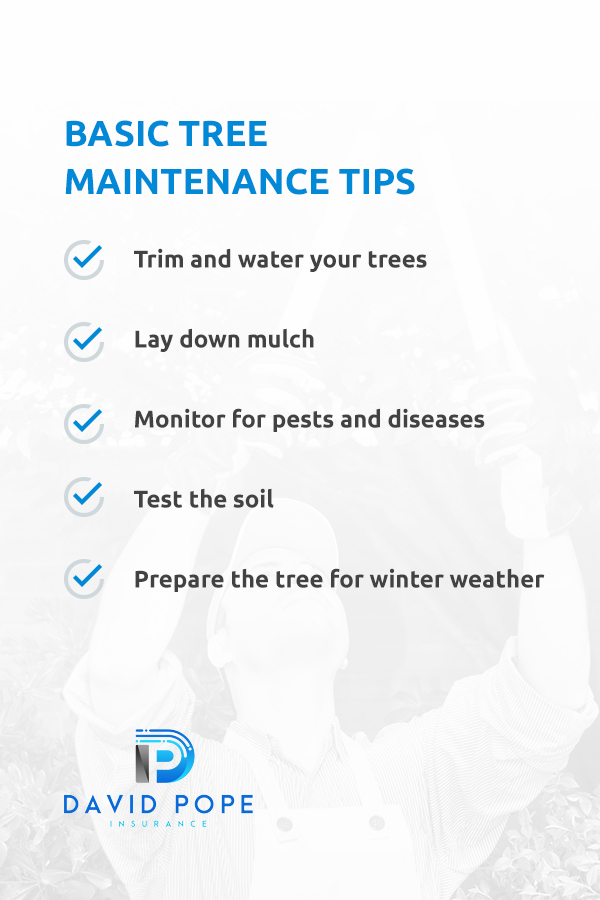

Preventing falling trees is key when you are a homeowner with trees on your property. As a homeowner, you may want to take steps to minimize damage from your trees. Home insurance does not cover poor tree maintenance, so you should monitor the health of your trees and prepare them for storms and winter weather:

At David Pope Insurance, we offer our clients financial stability with the lowest available rates on the market. Our locally-owned insurance firm has been in the business for 15 years, and we have more than 20 years of industry experience. Through David Pope Insurance, you can protect your belongings without breaking your budget.

Along with home insurance, we can also provide auto insurance, life insurance and commercial insurance. We know every individual has unique insurance needs, which is why we aim to be as flexible as possible in the coverage options we provide our clients. Our flexibility has made us one of Missouri’s most reputable insurance brokers.

When you tell us about your unique insurance needs, we can help you figure out the best way to get the coverage you need for the most affordable price. Whether you are a first-time homebuyer or you are looking for a high-value vacation home, we can help you cover your dream property.

With David Pope Insurance, finding the right insurance policy is easy and stress-free. If you live in Missouri and are looking for homeowners insurance, contact us at David Pope Insurance or request a fast, free quote today.