As with any residence, it is crucial to protect the physical structure of your mobile home and the belongings within it. Mobile homes have grown in popularity among affordable housing options in the United States. However, despite the similarities between mobile homes and traditional site-built homes, this type of dwelling doesn’t usually qualify for homeowners insurance. Instead, you need mobile home insurance — sometimes called manufactured home insurance — to cover you if your mobile home is damaged.

Mobile home insurance is designed for the unique needs of mobile homeowners who are looking to protect their physical property and personal effects. Unlike traditional homes built on construction sites, mobile homes are assembled in factories and delivered to your property as one complete piece. Due to the unique creation of mobile homes, these dwellings require different insurance coverages than site-built homes. They need a mobile home insurance policy.

Some other common characteristics of mobile homes which can affect how insurance works include the following:

The unique construction of mobile homes, and their vulnerability to certain weather conditions, often disqualifies them for conventional homeowners insurance. Even though mobile home insurance and homeowners insurance provide similar coverages, you must purchase the right policy for your home type to protect the dwelling’s structure and your personal property.

The items covered on a mobile home insurance policy should be tailored to your specific needs. Your policy can differ significantly from other mobile homeowners based on the many coverage options available — from the limits you can carry on standard coverages essential for most mobile home insurance to the extra coverage features needed for particular lifestyles.

Any standard mobile home policy should include three basic coverage options:

Your standard mobile home insurance will cover specific risks and threats, which your policy may refer to as named or covered perils. Covered perils typically include the following:

Check what events are covered in your standard mobile home policy to determine what potential coverage features you need to add.

Extra coverage options are valuable for a mobile home insurance policy to increase the home’s protection level. Depending on the insurer, the following optional endorsements could come standard with your policy or at an additional price:

Search for an insurance company that offers the extra coverage features you require. For example, if you live in a high-risk flood zone or seismically active region, you may want to add an endorsement to cover damages from natural disasters. While it is best if this coverage comes included in your standard policy, some potential coverage features are typically excluded or may not be provided by the insurer at all.

Most mobile home insurance doesn’t cover flood damage or “earth movement,” so you must purchase separate flood insurance and earthquake coverage if these events are a primary concern.

Despite the similar coverage options for mobile home insurance and homeowners insurance, the two are not precisely the same. In both cases, the homeowner wants to protect the actual dwelling against damages, protect the belongings kept inside and have general liability coverage for injuries or damage caused to others on the property. However, without the correct insurance for your particular type of home, you could risk being unqualified for these coverages when disaster strikes.

If you purchase homeowners insurance, it’s generally priced based on the replacement cost of your home. Mobile home insurance differs from homeowners insurance because it’s typically priced on the actual cash value of the property, which can be significantly less than the replacement cost. Additionally, mobile home insurance often has lower limits for personal property coverage.

Mobile home insurance is not required by law, but proof of insurance may be necessary for some situations. Certain mortgage companies and mobile home communities may require that you purchase coverage before they work with you. An excellent mobile home policy can be helpful when managing risk or loss, so check for any insurance requirements if you plan to take out a mortgage or place your home in a mobile home community.

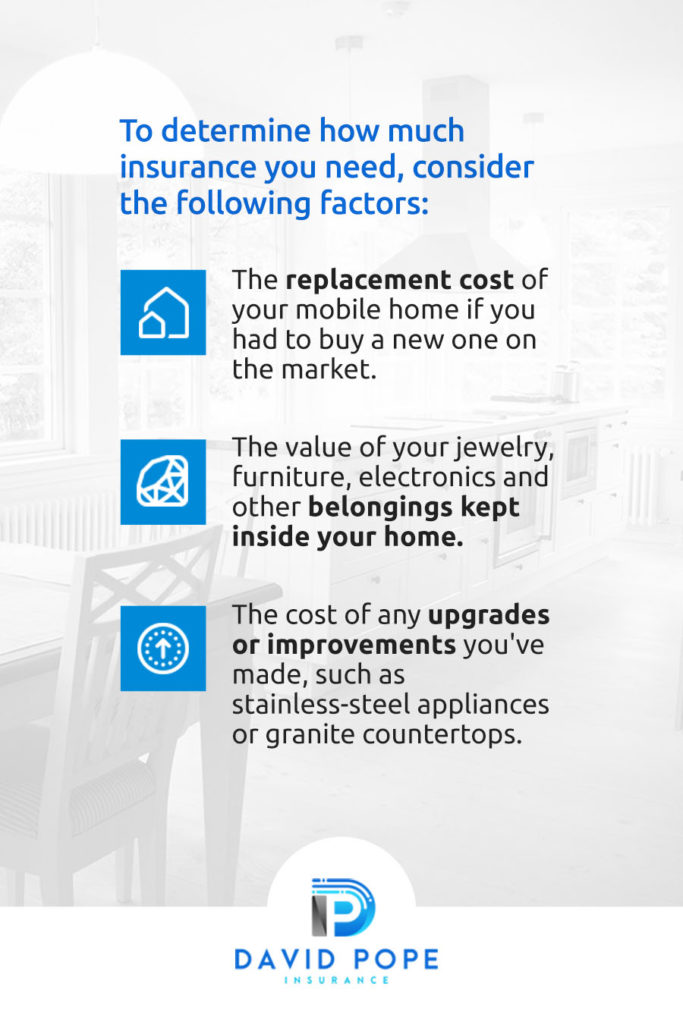

Another reason you may want mobile home insurance is to cover the cost of a rebuild. To determine how much insurance you need, consider the following factors:

A mobile home insurance policy will protect your home and personal effects if you cannot afford to replace them yourself after a sudden disaster. It may be necessary to cover your home up to its total replacement value as a safety precaution for your investment.

How much does mobile home insurance cost? The price for mobile home insurance ranges from a few hundred dollars to thousands of dollars annually based on your particular situation. Your policy’s cost depends on the numerous variables the insurance company considers when pricing your policy. While some factors are out of your control, you can adjust others to help lower your insurance rates.

Fixed factors that affect the cost of insurance include:

Factors within your control that could influence the cost of mobile home insurance include:

The best thing you can do to lower your rates is to compare quotes. The more quotes you can compare, the better informed you will be when choosing a policy.

Policies can vary widely in cost, even among the highest performing mobile home insurance companies. Before going with the first option you find, consider reaching out to a professional company that can help you quickly compare quotes from various insurers in your area. You can easily buy mobile home insurance from a national or regional insurance company. However, getting quotes from multiple insurance companies could help you find the best mobile home policy for the most affordable price.

A mobile home insurance agency like David Pope Insurance Services, LLC can provide all the information you need to make an educated decision, including any applicable discounts. While discounts may vary between insurance companies, some common ones include bundling multiple policies, having a home security system, being the home’s original owner, autopay options and a new home discount.

Modular homes must comply with the same building standards as conventional site-built homes. Modular homes look more like a traditional home, often have multiple stories and a basement or crawl space, sit on a more permanent foundation and cannot be relocated after assembly. The distinction between modular homes and mobile homes might even affect your insurance choices since mobile home insurance usually doesn’t cover a modular home’s needs and protection level.

While modular homes and mobile homes are both constructed in factories, there is little else in common between these two home types. Mobile homes are delivered as a complete unit with a single floor that can rest on a non-permanent foundation. On the other hand, modular homes are transported in multiple pieces assembled at the building site and affixed to a more permanent foundation. Most insurance companies will have you purchase a traditional homeowners insurance policy to cover your modular home.

It is more challenging to obtain insurance for older mobile homes, as many were built with unregulated safety standards. It wasn’t until June 15, 1976, that federal law mandated stricter building standards for mobile home construction. The U.S. Department of Housing and Urban Development (HUD) will not inspect or issue tags for mobile homes constructed before this date, even if modifications have been made to meet the standards.

If your mobile home was built before 1976, you might have to purchase coverage through a regional mobile home insurance company. Most national insurance companies will rely on your mobile home having a HUD certification label, something impossible for older homes to obtain. Contact a professional company that can help you get quotes from insurers in your area willing to cover your home regardless of its age.

With how much mobile home insurance is for the typical homeowner, you will want to choose the best coverage from the best company for the best price. However, the factors dictating your coverage requirements and cost can vary widely between each mobile homeowner. The best mobile home insurance company for you may be different from the best company overall.

Although mobile home insurance isn’t available through all insurance companies, many insurers are still dedicated to bringing you coverage for your mobile home. It is best to explore all the insurance options in your area to ensure you get the proper coverage and the best deal.

For example, many companies don’t include floods and earthquakes as covered perils in their standard mobile home policies. If these coverages are something you require, know that the few other companies that offer these coverages do so for an additional price. In addition to the coverage options, you want to evaluate all mobile home insurance companies based on cost, customer service and available discounts.

An experienced company, like David Pope Insurance, can help homeowners compare these factors to find the right policy for their needs.

David Pope Insurance is a flexible, progressive company dedicated to finding the best premiums and coverage options for mobile homeowners in Missouri. We will work with numerous insurance companies to provide you with peace of mind knowing you’ve purchased the right mobile home policy for your needs at an affordable price.

Get your fast, reliable quote for mobile home insurance rates in your area today, or give us a call at 636-583-0800 for more information. We want to answer any questions you have about your new mobile home insurance policy.